Editor’s Note: This blog entry was originally published on May 31, 2016, and was updated on July 20, 2020.

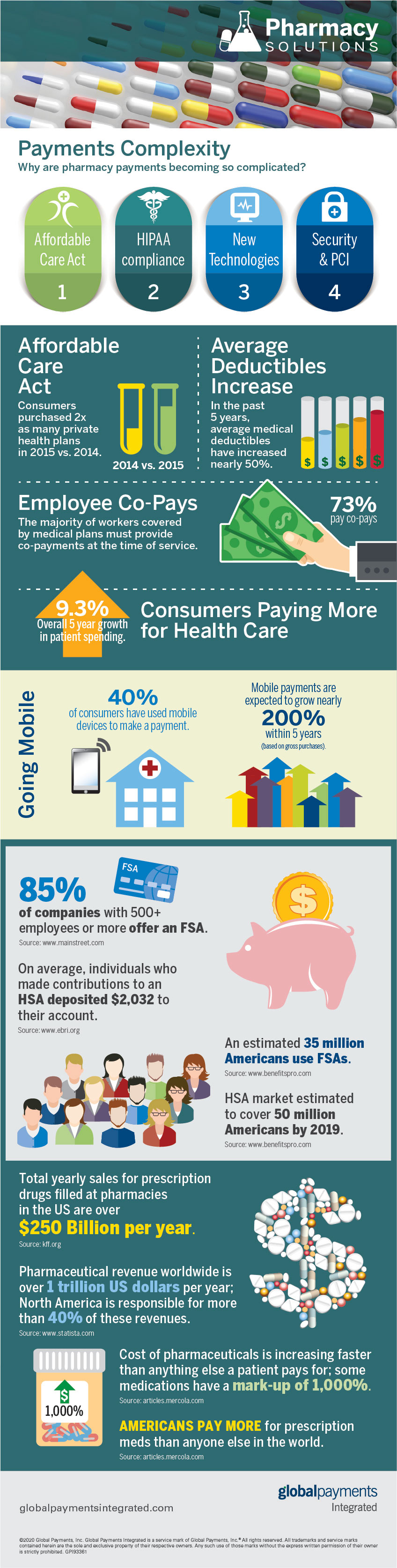

Pharmacy payments and billing are in a constant state of change. Government regulation, insurance involvement, and new technologies drive continual change for the pharmacy industry. A few main causes of change over recent years include the Affordable Care Act, HIPAA compliance requirements, new technologies, and security/PCI requirements.

Here are a few statistics showing how pharmacy payments have changed over recent years.

Healthcare Payments

- Consumers purchased two times as many private health plans in 2015 vs. 2014.

- Between 2011 and 2016, average medical deductibles increased nearly 50%.

- The majority of workers covered by medical plans must provide co-payments at the time of service - 73% pay co-pays.

- Consumers are paying more for healthcare - the overall 5-year growth in patient spending between 2011 and 2016 was 9.3%.

Mobile Payments

- As of 2016, 40% of consumers had used mobile devices to make a payment.

- In 2016, medical payments were expected to grow nearly 200% within five years (based on gross purchases).

Flexible Spending Accounts (FSA) and Health Savings Accounts (HSA)

- 85% of companies with 500+ employees or more offer an FSA.

- On average, individuals who made contributions to an HSA deposited $2,032 to their account.

- An estimated 35 million Americans use FSAs.

- In 2016, it was estimated that the HSA market would cover 50 million Americans by 2019.

Prescription Drug Costs

- Total yearly sales for prescription drugs filled at pharmacies in the US are over $250 billion per year.

- Pharmaceutical revenue worldwide is over $1 trillion USD per year; North America is responsible for more than 40% of these revenues.

- Cost of pharmaceuticals is increasing faster than anything else a patient pays for; some medications have a mark-up of 1,000%.

- Americans pay more for prescription meds than anyone else in the world.