Editor’s Note: This blog entry was originally published on June 28, 2016, and was updated on November 29, 2021.

With the pandemic and ongoing changes in healthcare, such as increased telehealth visits, a lot has changed in healthcare payment processing. Our infographic takes a look at some of the latest statistics in medical payments.

Current patient payment methods

Many different factors contribute to the healthcare payments ecosystem, such as insurance coverage, deductibles, and the patient’s ability to pay. Research found that 45% of consumers fear bankruptcy from a major health event, and that consumers had borrowed $88 billion to cover healthcare payments in the past 12 months.

A January 2021 Healthcare Payment Experience report by PYMNTS.com and Rectangle Health found that:

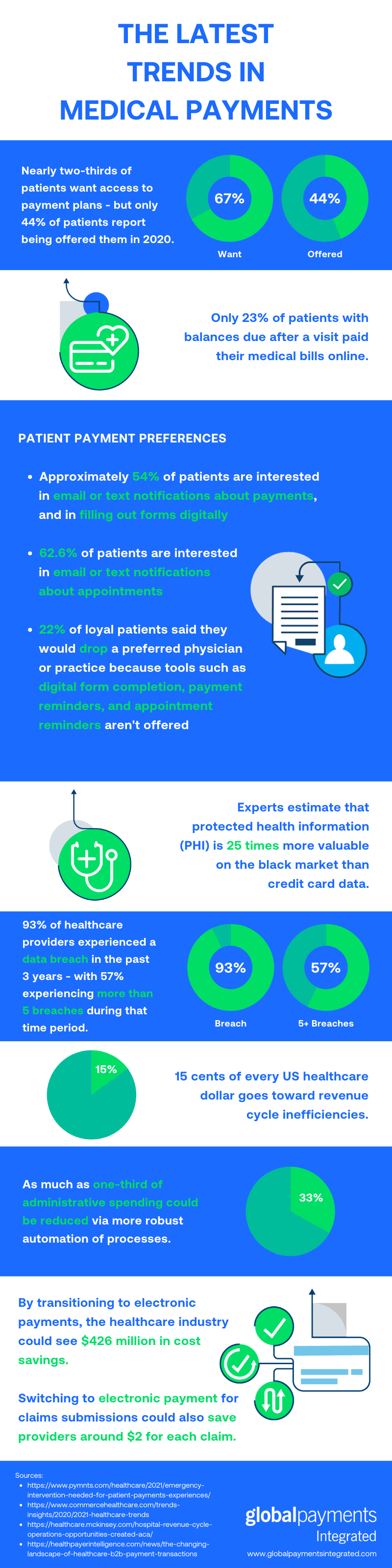

- Nearly two-thirds of patients want access to payment plans - but only 44% of patients report being offered payment plans in 2020.

- Only 23% of patients with balances due after a visit paid their medical bills online.

Patient payment preferences

The above statistics show the importance of medical practices offering their patients a wide variety of payment options, as well as patient engagement tools to take the friction out of the patient experience. PYMNTS.com and Rectangle Health found that:

- 54% of patients are interested in monitoring their upcoming provider payments digitally

- 53.5% of patients are “very” or “extremely” interested in email or text notifications about payments

Patient engagement tools

The same report also underscored the popularity of patient engagement tools such as appointment reminders and online forms, finding that:

- 62.6% of patients are “very” or “extremely” interested in email or text notifications about appointments

- 53.7% of patients are “very” or “extremely” interested in filling out forms digitally

In fact, 22% of “very” or “extremely” loyal patients said they would “drop a preferred physician or practice because tools such as digital form completion, payment reminders, and appointment reminders aren’t offered.”

Global Payments Integrated offers a suite of tools that allow practices to engage patients at every touchpoint of the patient journey.

Prior to coming into the doctor’s office, patients can book an appointment online, pay a deposit, fill out forms digitally, and receive appointment reminders. Once at their appointment, they can self-check-in via a QR code. Afterwards, they can digitally receive a secure link to pay any outstanding balance. Take a look at the video below to see these solutions in practice in the medical field.

Data security

Medical practices have to ensure the security of their data, both payment data and patients’ protected health information (PHI). There are different standards and requirements for different types of data, such as PCI compliance standards for payment data and HIPAA compliance rules for PHI. If these rules are not adhered to, data breaches can occur, compromising payment information and patient data.

- A recent report found that 93% of healthcare providers had experienced a data breach in the past three years - with 57% experiencing more than five breaches during that time period.

- Healthcare far outpaces the banking, insurance, and finance industry in breaches.

- Experts estimate that PHI is 25 times more valuable on the black market than credit card data.

Costs and savings

Revenue cycle management (RCM) is a large part of running a healthcare practice. RevCycleIntelligence defines healthcare RCM as “the financial process that facilities use to manage the administrative and clinical functions associated with claims processing, payment, and revenue generation. The process encompasses the identification, management, and collection of patient service revenue.”

RCM is essential to managing cash flow. While some practices have “gone digital” and automated their processes, many haven’t - and research shows there are cost savings to be had:

- 15 cents of every US healthcare dollar goes toward revenue cycle inefficiencies.

- As much as one-third of administrative spending could be reduced via more robust automation of processes.

- By transitioning to electronic payments, the healthcare industry could see $426 million in cost savings.

- Switching to electronic payment for claims submissions could save providers around $2 for each claim.

Conclusion

As you can see, there are a lot of factors that make up the business side of running a medical practice. ISVs can make things easier for their healthcare clients by partnering with a trusted payments partner who can provide a robust payment processing solution, as well as a suite of patient engagement tools. Contact us today to learn more.