If you work in a technology-related field, you’ve likely heard the acronym “OCR” in recent years. But what does OCR stand for, and how does it work? Read on to learn the answers to these questions, as well as how OCR fits into payment processing.

What Does OCR Stand For?

OCR stands for “optical character recognition.” Occasionally, it is also referred to as “optical character reader” technology.

What is OCR?

TechTerms defines optical character recognition as “a technology that recognizes text within a digital image.” It is often used to recognize text in scanned paper documents, but has many other uses as well.

How Does OCR Work?

OCR technology locates and recognizes characters, such as numbers, letters, or symbols, within a digital image. The software can then export the text, or convert the characters into editable text within the image file, so that the text can be used for data processing.

The process works like this: The OCR scanner scans a physical item such as a document or credit card, and the software converts it into a black-and-white image. The software then analyzes the image, coding the lighter areas as background and the darker areas as characters that need to be recognized.

The final step is the software further processes the darker areas to recognize letters and numbers. It identifies these characters using one of two different types of algorithms - pattern recognition or feature detection.

Pattern Recognition

With pattern recognition, an optical character recognition program uses examples of various fonts and formats of text that it has been given to compare and identify characters in the scanned document.

Feature Detection

With feature detection, an optical character recognition program has a set of rules about specific features of each letter or number, and it uses these rules to identify characters in the scanned document. In order to make these comparisons, the program relies on features such as the number of curves, crossed lines, or angled lines in a character.

Once the OCR program identifies a character, that character is converted into code that computer systems can use for further data processing.

How is OCR Used in Payments?

Optical character recognition can be used to help automatically process and manage credit card data. If you have ever made a payment via your mobile phone and seen the option to take a photo of your credit card rather than manually typing in the card number, that feature is powered by optical character recognition.

From an image of a credit card (for example, taking a photo of your credit card within a mobile app), OCR software locates and identifies the various characters on the card and then converts them into data that can be more easily processed.

A few examples of cardholder data that can be recognized and converted by OCR include:

- Card type

- Card vendor

- Cardholder name

- Card number or primary account number (PAN)

- Expiration date

- CVC

Benefits of Using OCR in Payments

OCR is a valuable technology in the payments world. It can provide the following benefits to merchants.

Increase Security

Since an OCR program can recognize credit card data, you can set up security features when implementing optical card recognition into the payments process. As an example, you can set up the OCR system to remove cardholder data after a one-time payment is processed. You can also set up the system to quarantine cardholder data and encrypt it for safer storage.

Reduce Errors

When the data entry process is automated with optical character recognition, you can avoid the errors that inevitably come with manual data entry.

Improve Speed

OCR can simplify the process, thus improving speed for processes like payments, user onboarding, identity validation, and more.

Other Uses for OCR

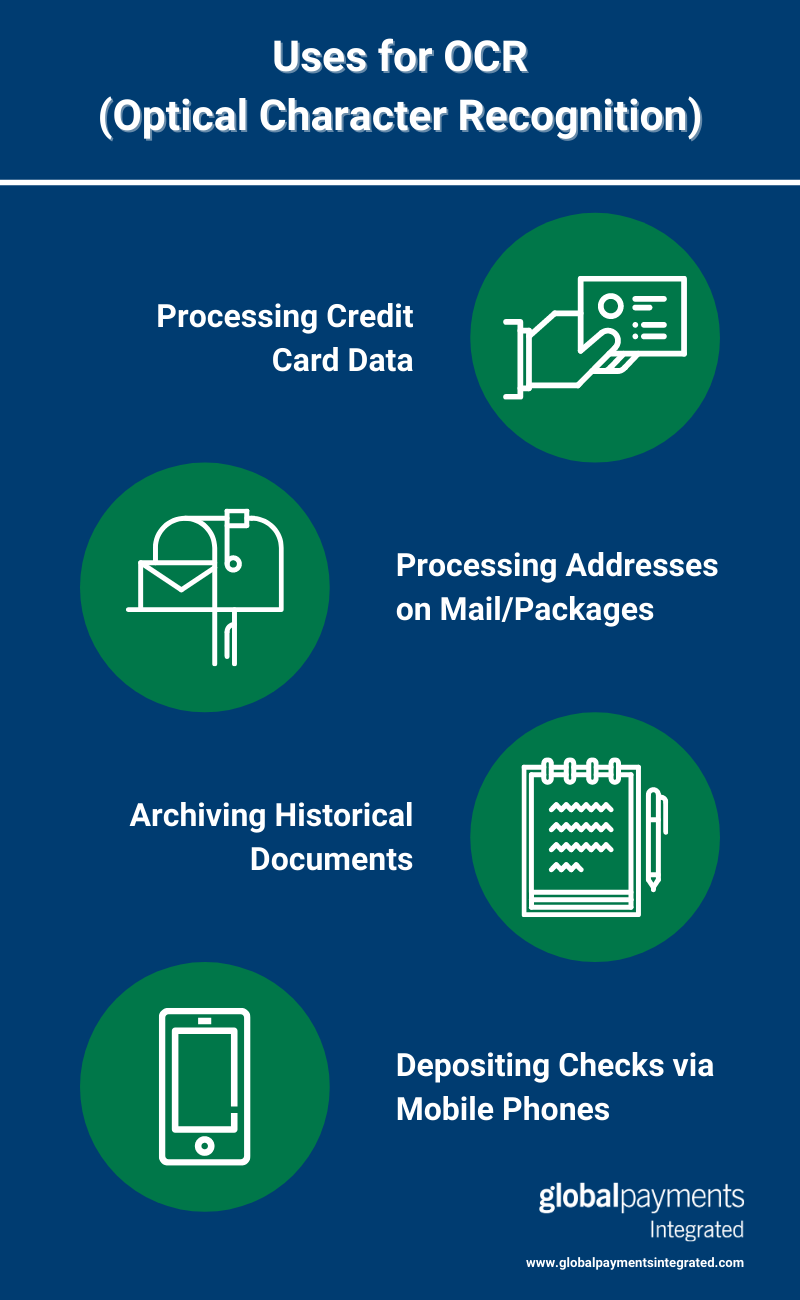

In addition to processing credit card data, optical character recognition can be used in a wide variety of other ways. Below are just a few examples.

Even though OCR technology was initially developed to read printed text, it can also identify handwritten text as well. The United States Postal Service uses optical character recognition to process packages and mail based on the recipient’s address listed on the item.

OCR is also used to archive historical documents, such as newspapers or magazines, into searchable data formats.

In recent years, you may have noticed that you can now deposit a check to your bank simply by taking a photo of it with your cell phone and submitting it through your banking app. OCR is the technology that enables this to happen.

Conclusion

Optical character recognition is used in a number of different ways across industries. It has valuable benefits when used in payment processing.

Global Payments Integrated supports optical character recognition technology through our Payfields product. When a consumer begins to enter a payment using a mobile phone, the mobile phone keyboard will recognize the data field as a credit card field. At this point, the consumer will receive an option to autocomplete the data fields with previously-saved card information, or, through the use of OCR technology, to scan their credit card instead.

Including optical character recognition technology in the software solution you offer to your clients is an additional meaningful way for ISVs to enable commerce and make payment processing easier and more efficient. For more information about Payfields or any pf Global Payments Integrated solutions, contact us today.