What is the Payments Ecosystem?

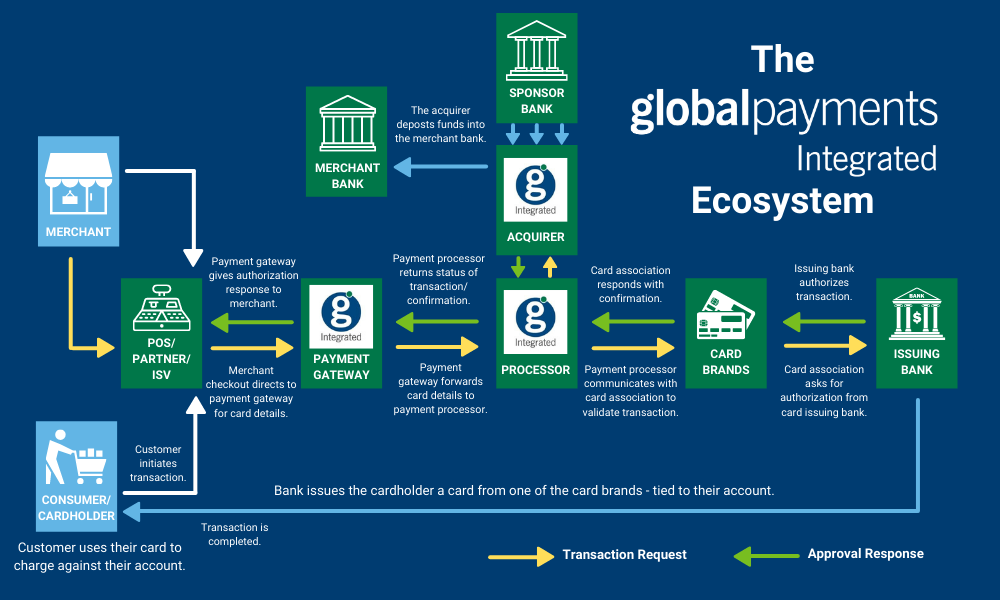

In the payments industry, “payments ecosystem” is a term that refers to all the different entities involved in making and processing a payment, as well as the process of how payment data and authorization flow between them all.

The Players in the Payments Ecosystem

In order to understand the structure of the payments ecosystem, and how data flows through it, you need to first understand the definitions of the different players in the space. Some of them are defined below.

- Consumer/Cardholder: The customer that presents their card for payment of goods or services.

- Merchant: The business that sells goods or services.

- POS: Point of sale. The time and place where a retail transaction is completed - the point at which a customer makes a payment to the merchant in exchange for goods or after provision of a service.

- ISV: Independent software vendor; a business that designs and sells business management software.

- Payment Gateway: Connects POS to payment processor and assists with transaction authorization.

- Payment Processor: Organization that partners with acquirers to open merchant accounts, handle support, manage payment processing, and build technology on behalf of acquirers.

- Payment Acquirer: An acquirer (or “acquiring bank”) solicits, underwrites, and owns the accounts merchants need to accept credit cards. They can provide the technology permitting businesses to process transactions, take on chargeback risk, and deposit funds into a merchant’s bank account.

- Payment Facilitator: A registered merchant service provider that’s commonly thought to help simplify the merchant account enrollment process.

- Sponsor Bank: Responsible for funding to the merchant and ACH payments to the payment processor. They are also responsible for paying the card brands and the issuing bank their portion of the interchange fees.

- Merchant Bank: Acquirer deposits funds into the merchant bank.

- Card Brands: American Express, Discover, Visa, and MasterCard

- Issuing Bank: The issuing bank (or “issuer”) is the financial institution that provides the cardholder with their credit and a physical card. They are responsible for approving and declining transactions, customer billing, and collections.

The Typical Payments Ecosystem

In a typical payments ecosystem, each of the above entities is represented by a separate company. The downside to this structure is that merchants and ISVs have to interact with multiple companies for setup or troubleshooting, and they have to ensure that the process is consistently flowing along between companies without issue.

For an example of the typical payments ecosystem and how many separate companies are involved in order to process one transaction from start to finish, take a look at the video below.

The Global Payments Integrated Payments Ecosystem

The Global Payments Integrated payments ecosystem (illustrated below) differs from the typical model because Global Payments Integrated is the payment gateway and payment processor, as well as the acquirer. In many cases, we’re also the card issuer - we issue over 80% of all cards in North America.

Benefits of the Global Payments Integrated Payments Ecosystem

Lowered Costs

Because Global Payments Integrated takes on multiple roles in the process, this model cuts costs for ISVs, such as expensive cost layers with resellers, or third-party fees to acquirers. When working with a partner like Global Payments Integrated, the only costs are the fees associated with the card brands - which greatly increases the available revenue to be shared with our partners.

More Visibility

This closed-loop payments ecosystem also gives Global Payments Integrated and the partner ISV visibility into the entire lifecycle of each transaction. This type of all-in-one solution greatly simplifies the technical and customer service aspects of payment processing. In addition, a closed-loop ecosystem helps reduce cost at the merchant level but also increases revenue opportunities to software and solution providers.

Value-Added Technology

In addition to payment processing, we also provide value-added technology to help your merchants grow their business. From alternative financing to commerce enablement solutions to ensuring compliance with PCI DSS security standards, we help ISVs provide merchants with more touchpoints and more control over the customer experience - and we provide all of this through one partnership and one platform.

Our technology solutions enhance the customer journey at every touchpoint, starting from the customer’s first interaction. Our phone intelligence software allows businesses to access relevant consumer information before answering a call. We provide technology to send appointment reminders, have customers fill out online forms, send quick links to pay outstanding balances, and more. Our analytics and reputation management tools deliver intelligent data to provide businesses with deep visibility into their customer base and competitors.

Global Payments Integrated is unique in offering this legible intelligence - each of our products build on each other to help make payments work smarter. Improving the customer journey ultimately results in increased margin for our software partners. We enable our software partners to drive profitability with additional revenue share opportunities, provide a consistent experience for merchants and their customers, and leverage data across their ecosystem.

Conclusion

Global Payments Integrated’s unique payments ecosystem provides a significant way for ISVs to further monetize payments. If controlling that much of the payments environment sounds like a daunting task, don’t worry. Global Payments Integrated provides dedicated resources and experts to help you every step of the way.

Partnering with a true technology partner like Global Payments Integrated allows you to focus on your core competencies and leave the rest to us. To learn more about creating a partnership with Global Payments Integrated, contact us today.