What are Invisible Payments?

Invisible payments are payments that happen automatically, almost in the background, without the purchaser having to provide additional credentials or take any additional actions to trigger the payment.

The use of this form of payment is expected to grow, with Juniper Research estimating that invisible payments will process over $78 billion in transactions by 2022.

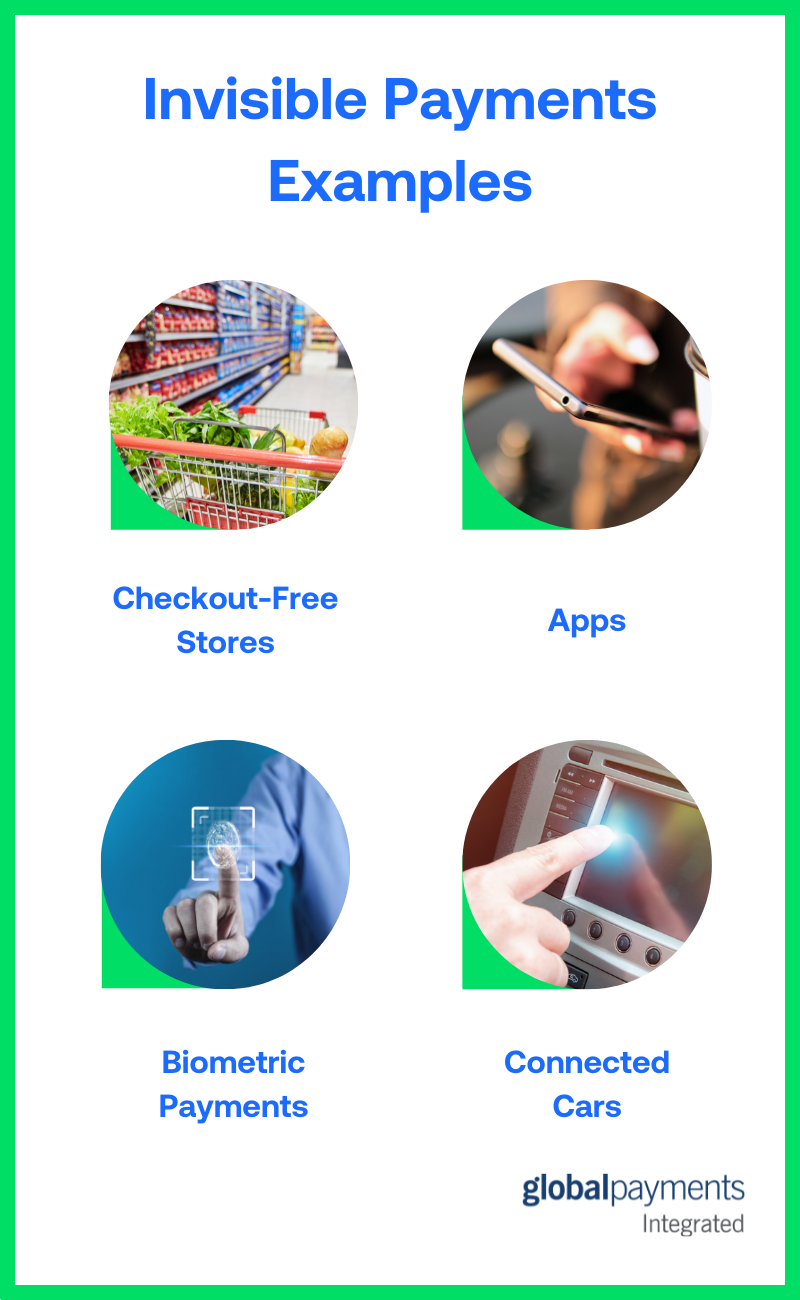

Examples of Invisible Payments

Checkout-Free Stores

Checkout-free stores such as Amazon Go use invisible payments to provide a “just walk out” shopping experience. At these stores, there is no checkout required. Customers simply use an app on their smartphone to check-in when entering the store. From that point on, technology (using a combination of sensors, cameras, machine learning, and more) detects when a customer picks up an item from the shelf and keeps track of those items.

Once the customer has finished their shopping, they simply leave the store. At that time, their Amazon account is charged for the items they have selected, and they are sent a receipt. This is a prime example of invisible payments because it happens in the background without the customer taking additional actions to trigger the payment.

Apps

One of the most well-known examples of invisible payments is Uber. Once a customer has set up their account and payment method through the app, after they request and complete a ride, the app automatically charges the customer’s stored payment method without the customer having to take any additional actions.

Biometric Payments

Biometric authentication is another method by which invisible payments are facilitated. Amazon has recently started implementing Amazon One in some of their Amazon Go stores. Amazon One allows customers to use their palm rather than an app to sign into the store.

Amazon intends for Amazon One technology to provide “a quick, reliable, and secure way for people to identify themselves or authorize a transaction while moving seamlessly through their day.”

In China, facial recognition payments are becoming popular, with 1,000 convenience stores installing a facial payment method in 2019. One example is Smile to Pay, from the company Alipay, which scans a customer’s face to authenticate their payment.

Connected Cars

Car manufacturers are starting to see the value of in-vehicle commerce. In addition to accessing navigation systems, weather forecasts, and traffic reports, some of these “connected cars” are now being enabled to allow drivers to pay for fuel directly from the car touchscreen.

The global connected car market is predicted to reach $225.16 billion by 2027, showing that the use of this technology is expected to continue to increase.

What are the Benefits of Invisible Payments?

Customer Convenience

Invisible payments reduce the number of items a customer has to bring with them to make a payment (credit cards, debit cards, smartphone, etc.). In addition to being convenient, this also provides customers more flexibility in payment - for example, if they forget their wallet or smartphone, they are still able to make a payment.

Security

Invisible payments do not involve the use of physical credit or debit cards, which removes the risk of a lost or stolen card.

Many invisible payment methods use biometrics to authenticate payments. Biometric authenticators, such as fingerprints or palm prints, facial or retinal scans, or voice recognition, are extremely difficult to copy or fake, adding an additional layer of payment security.

A Step in the Innovation Process

The technology for invisible payments has the potential to be used in combination with other services to make consumer life more convenient. For example, Amazon envisions its Amazon One technology eventually being used to enter locations like stadiums or for badging into workplaces.

What are the Barriers to Adoption of Invisible Payments?

While the use of invisible payments continues to grow, it has not yet been widely adopted in the United States. Here is a look at a few possible reasons.

Too Many Options

If different businesses set up their own invisible payment system specific to only their company, then customers may have to, for example, log into their Amazon Go app to shop at an Amazon Go store, and then toggle to a different app to shop at another checkout-free store.

Consumers may find usage of so many additional apps cumbersome, and may feel they clutter their phone. They may find the usage of invisible payments less convenient than more traditional payment methods.

Privacy Concerns

Many consumers are concerned with the storage of their personal data and payment data, and worried about the possibility of a data breach.

Some consumers are also distrustful of the use of their personal characteristics (fingerprints, etc.) for biometric authentication of payments, so they may prefer to pay with more traditional payment methods such as credit cards.

Scaling

With the technical infrastructure required to set up an invisible payments system such as a check-out free store, invisible payments may be better suited to some businesses and not as well suited to others.

For example, larger retail outlets with a number of different product lines would require more implementation time than a smaller company providing a limited selection of items.

Looking Ahead

What invisible payments boil down to is providing frictionless payments and giving consumers another option to pay the way they want to pay. While the future of payments may see increased use of invisible payment methods, in the meantime ISVs should ensure their software solution offerings include functionality for the payment methods that consumers have already been shown to prefer - such as credit cards and contactless payments. To see how Global Payments Integrated can help integrate payment processing into your software solution, contact us today.