Buy now pay later (often abbreviated as BNPL) is an alternative financing payment method that has seen a meteoric rise in recent years. BNPL services allow consumers to buy an item or purchase a service now and pay for it over time in installments. Take a look at our infographic below to learn about BNPL growth, projections for future use, and the benefits ISVs and merchants can gain by offering this payment functionality.

The recent growth of BNPL

Buy now pay later services help consumers manage their cash flow, allowing them to make purchases that their budget might not allow for otherwise. It’s no surprise, then, that the payment method has seen an increase in usage in recent years.

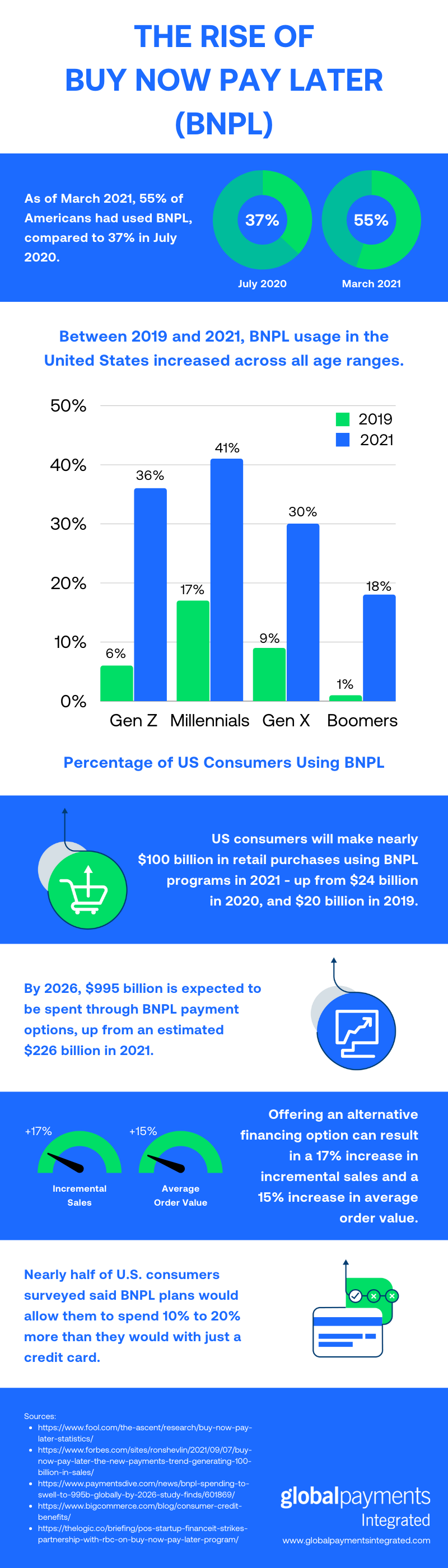

- 55% of Americans have used BNPL as of March 2021, compared to 37% in July 2020.

- When looking at demographics, BNPL use has recently increased across all age ranges in the US.

- The percentage of Gen Z consumers in the US using BNPL has grown six-fold, from 6% in 2019 to 36% in 2021.

- Millennials’ use of BNPL has more than doubled since 2019, from 17% to 41%.

- Gen X consumers’ adoption of BNPL more than tripled since 2019, from 9% to 30%.

- Baby Boomers are also using BNPL more, with their use increasing from only 1% in 2019 to 18% in 2021.

Projections about the future of BNPL

- US consumers will make nearly $100 billion in retail purchases using BNPL programs in 2021 - up from $24 billion in 2020, and $20 billion in 2019.

- By 2026, $995 billion is expected to be spent through BNPL payment options, up from an estimated $226 billion in 2021.

Benefits of offering BNPL

- Offering an alternative financing option can result in a 17% increase in incremental sales and a 15% increase in average order value.

- Nearly half of US consumers surveyed said BNPL plans would allow them to spend 10% to 20% more than they would with just a credit card.

Offer buy now pay later solutions

Global Payments Integrated now offers Delay Pay*, powered by TuaPay. With Delay Pay, merchants can give customers the option to easily buy now and finance through monthly installments. Customers can take advantage of more purchasing power. They can easily choose monthly financing options when paying, whether online or in-person.

Delay Pay simplifies the installment plan with a transparent payment schedule and no hidden fees. An easy and quick application process requires only a few data points for a real-time decision.

Merchants can also benefit from offering Delay Pay to their customers. It reduces the chance of missing out on a sale because of cost barriers. Other merchant benefits include:

- Boost revenue by offering flexible payment options

- Increase cash flow by receiving the full purchase amount from the lending company upfront

- Stay ahead of the competition by offering more payment methods

Conclusion

As you can see from the infographic, the usage of buy now pay later will likely continue its recent rapid growth. This payment method offers benefits to both merchants and end customers, so ISVs should ensure this functionality is included within their software offering. Contact us today to learn more.

*Global Payments Integrated is not a consumer lending company. Delay Pay is powered by TuaPay, a consumer financing solution that pays merchants upfront and allows consumers to pay over time.