Everyone wants to make more money without doing the heavy lifting. And whether you know it or not, you happen to be in the coveted position to do just that.

As an ISV, you’ve probably realized that in today’s market, payments acceptance alone isn’t as strong a differentiator as it once was.

If you’re only focusing on integrating basic payments tech into your software offering, you’re leaving money on the table. There’s an entire cabinet of new revenue just waiting for you to unlock it. (All you have to do to get the key is read on.)

Beyond payments, you can create more integrated value and enhance profitability by adding capabilities to your offering that help drive positive interaction points between a business and its customers.

We’re talking about customer experience technology.

Keep reading for an inside look at how automating customer touchpoints for your small business clients can add a layer of value to your software offering that brings in more revenue for both you and your clients (no muscle power required).

The competitive advantage your clients are looking for

Customer experience is a pretty broad term. So what do we mean exactly when we say you can add it to your tech stack? And what does that look like for your clients?

In short, we’re talking about technology that enables commerce and helps your merchants improve all those small interactions that make up a customer’s experience with their business.

Let’s take a closer look by comparing and contrasting a business-customer interaction with and without customer experience tech:

Without customer experience tech

Let’s say a customer arrives at your client’s veterinary clinic for an appointment. The waiting room at the clinic is packed, and they’re stuck at the back of a long line to check in for their appointment at the front desk. Once they finally get to the front, they’re handed a packet of paperwork to fill out prior to the appointment, detailing their insurance information and pet’s medical history.

Balancing pen and clipboard in one hand and Fluffy’s leash in the other, they rush to complete the questionnaire. Owner and dog go into the appointment feeling stressed and harried rather than calm and collected, which is bad news for your client.

But this story isn’t over yet. Weeks after the appointment, the customer gets a billing invoice in the mail with a request to mail back the payment by the due date … which is now two days from the date they actually opened the letter. With a bad taste in their mouth about the whole experience, they resolve to find a new vet for Fluffy’s next appointment.

Now … what if we flipped the script?

With customer experience tech

The customer walks into the clinic with Fluffy in tow. Instead of dealing with a backed-up office and a disorganized check-in system, they simply take their seat and leisurely get situated as they wait to be called. They already completed their paperwork online before even leaving the house and checked in for the appointment in real time when they arrived via the online customer portal on their mobile device.

The appointment goes great. And after it’s over, they’re sent a timely online payment request, which they can access via that same portal. The online statement breaks down the cost of each service, offers a series of payment options and has a chat feature available should the customer have any questions. Unlike in the first scenario, this time the customer will definitely be bringing Fluffy back for appointment number two. In fact, they can even schedule a follow-up appointment in that same portal.

The power of transforming customer interactions

For your clients

We’re not saying that offering customer experience tech to your clients will promise perfection every time. But we are saying it will fundamentally change the way your small business clients interact with their customers.

Customer experience tech is all about using what we know about customer behavior to create solutions that help businesses deliver better service.

That means clunky, disorganized manual processes, costly human errors and a mishmash of unconnected third party applications never have to darken your clients' doors again. Instead, your appointment-based small business clients can automate customer touchpoints that save time, improve accuracy and drive more revenue by meeting and exceeding customer expectations.

For you

Now, that’s great for your clients, but let’s talk about you. Adding another layer to your offering beyond payments also has the power to win you a stickier portfolio as an ISV. Why? Because you’re doing two essential things: making your clients’ lives easier while making them more money.

When you provide customer engagement capabilities, you automate your clients’ business processes and bring them the seamless experience of having all that functionality (plus payments) in one convenient, integrated system.

Getting to skip the hassle of setting up dozens of vendor relationships that exist in separate silos is a big pull for small business owners who already have enough on their plate. The more services you provide to help meet customer needs and create better customer experiences, the more your clients will depend on you — and the less their eyes will wander toward other providers promoting flashy solutions.

3 customer experience tech use cases

This all seems great, but what are some more specific examples of what customer experience tech looks like in action?

Good question. Customer experience tech can benefit a variety of verticals, including dental and healthcare providers, sports and recreation organizations, salons, automotive service shops and more. But for the purposes of this article, we’ll focus on use cases in the healthcare space.

Let’s explore three key ways customer experience tech can help make your clients’ everyday operations run smoother, win them customer loyalty and increase their revenue all at the same time.

1. Automate payment requests

When it comes to collecting payments:

It’s no secret that service-based small businesses need to successfully collect payments to survive. But here are some sobering stats: 39% of invoices aren’t paid on time in the US, with incorrect invoices being the reason for 61% of late payments. But about 11% of customers never even receive their invoices to begin with.

So how can you help your clients get paid? Customer experience tech that automates payment requests can make a big difference.

Automated payment requests provide the customer with a timely, accurate statement via a unique payment link sent by SMS or email that takes them to a branded, PCI-compliant online portal they can access on their mobile device. In addition to first-time requests, businesses can also send automated reminders for customers with unpaid balances.

Once in the online portal, the customer is presented with easier ways to pay — and more of them — including credit card, bank account and buy now pay later. From there, the portal can save customers’ payment info, so they don’t have to enter card details when their next bill is due.

The bottom line? When customers are able to complete their portion of the payment process quicker, your clients can collect payments faster, improving cash flow and decreasing accounts receivable.

2. Manage forms online

When choosing providers:

Whether it’s gathering information on insurance or medical history, or getting a liability waiver or consent form signed, chances are some of your clients’ daily operations include forms.

But the way your clients handle those forms could make or break their patients’ decision to give them their business. One study showed that when deciding between two doctor’s offices, 51% of patients would go with the doctor that allowed them to complete paperwork online before the visit.

And is it any wonder? When you think about the mad dash to accurately fill out forms before your name gets called, or having to show up 15 minutes early for your appointment to do paperwork, it’s not hard to see why an online option you can complete at home makes for a better user experience. On top of that, since COVID-19, people don’t want to touch germ-covered clipboards and pens or linger in crowded waiting rooms if they can help it.

Not only do online forms allow customers to skip the germs and the race against the clock, but they also help alleviate stress for your clients’ employees. Online form management cuts out manual transcription with digital entries that automatically upload customer data into the customer’s record, enabling data collection that’s secure and effortless. This eliminates bottlenecks and allows clinics to churn out more appointments — not to mention save major money on labor and resource costs.

Best of all? Online forms also allow the healthcare provider time to study a patient’s chart ahead of an appointment. Which in turn, empowers them to provide more informed care and a better customer experience.

3. Streamline check-in

Due to long wait times:

Nothing can put a customer in a bad mood faster than a long check-in process. One study showed that up to 30% of patients have left a provider’s office before being seen due to long wait times, while 20% said they’d consider switching providers if they experienced a long wait.

So how can you help oil the wheels of your clients’ check-in processes? With online check-in tech, customers can access self-service check-in on their phones by scanning a QR code or hitting an “I’m here” button sent prior to the appointment, whether they just walked in the doors, are in the parking lot or are 15 minutes out from the office.

This provides the customer a contactless, digital experience that delivers speed and convenience. As another plus, when it comes to patients who get anxiety around social interactions, providing an online check-in option could win your clients extra points. (Just be sure to educate clients on how to protect their QR codes against fraud!)

It’s a win-win: In addition to giving patients precious minutes back, adding digital channels for check-in also saves time for your clients’ front-line staff. When their service team doesn’t have to manually check in each individual patient, they gain the freedom to dedicate more time to answering customer questions, providing attentive customer support and completing higher-value tasks.

Communication support every step of the way

Sounding good so far? It gets even better. For every interaction described above, customer experience tech also includes messaging capabilities that allow the merchant to send automated communications via SMS text or email that are designed to do three key things:

- Request: The merchant can use this messaging function to send an automated request to a customer prior to a certain date or time, asking them to complete an action like making a payment or checking in for an appointment.

- Remind: The merchant can then send automated reminders regarding outstanding actions like unsigned forms or unpaid balances by scheduling a message a certain number of days after the missed due date. They can also choose to schedule continued reminders a set number of days following the first reminder until the action is successfully completed.

- Confirm: Once a customer does complete an action, the merchant can use the communications function to document it by automatically sending a receipt for a completed payment or a confirmation notice for a booked appointment or successful check-in.

Top benefits of customer experience tech

At this point, you’ve probably noticed some key themes about the benefits of customer experience tech. To recap, here’s a quick roundup:

- Improves customer satisfaction

- Delivers contactless convenience

- Cuts down wait times

- Saves time and money for your clients

- Optimizes business operations

- Improves utilization of invested resources and assets

- Creates a better employee experience

- Reduces manual consumer interactions for clients’ staff

- Minimizes human error

- Reduces collection fees

- Increases cash flow and drives revenue

All these benefits add up to another positive outcome: The right technology can lead to better retention and better reviews.

If your merchants’ customers are happy with their experience, they’ll be more likely to return. And when they take to social media to make a post about Fluffy’s healed paw with a side of customer feedback, they’ll be more likely to share positive reviews with their friends about the vet they used.

Unlock your revenue cabinet

Now that you’ve seen how customer experience tech can transform your merchants’ customer interactions, you might be wondering how you can get your hands on it — and what it will take to implement as part of your software offering.

Here’s the best part: It requires almost no work on your end.

Global Payments Integrated offers a Customer Engagement Suite that includes a portfolio of products and features designed to streamline merchant operations while enhancing the customer experience. In addition to automating processes and offering more ways to pay, our goal is to provide your merchants with meaningful ways to engage their customers at every touchpoint of the customer journey.

And all it takes is a single API. There’s no need to build your own UI or do integration work with third parties.

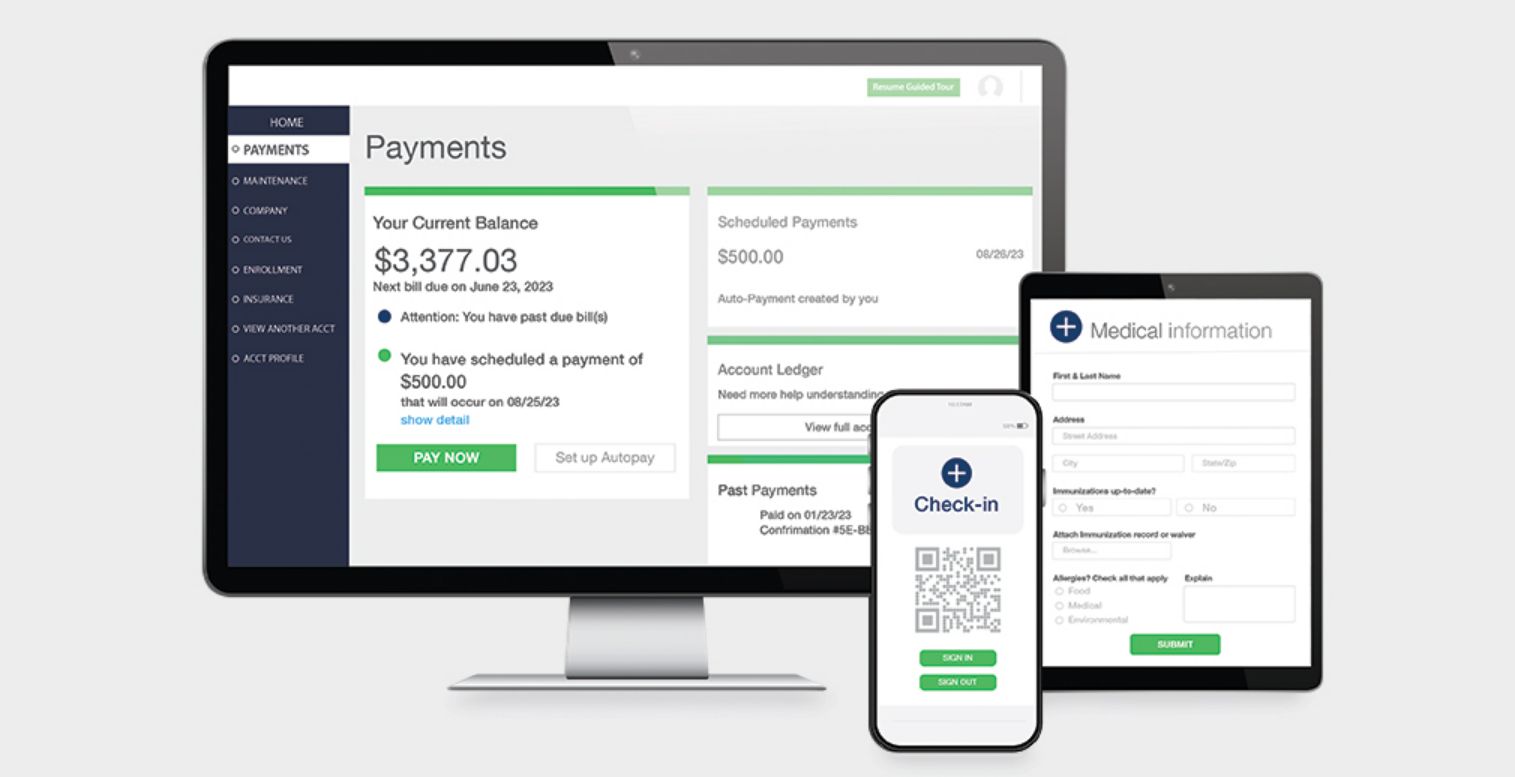

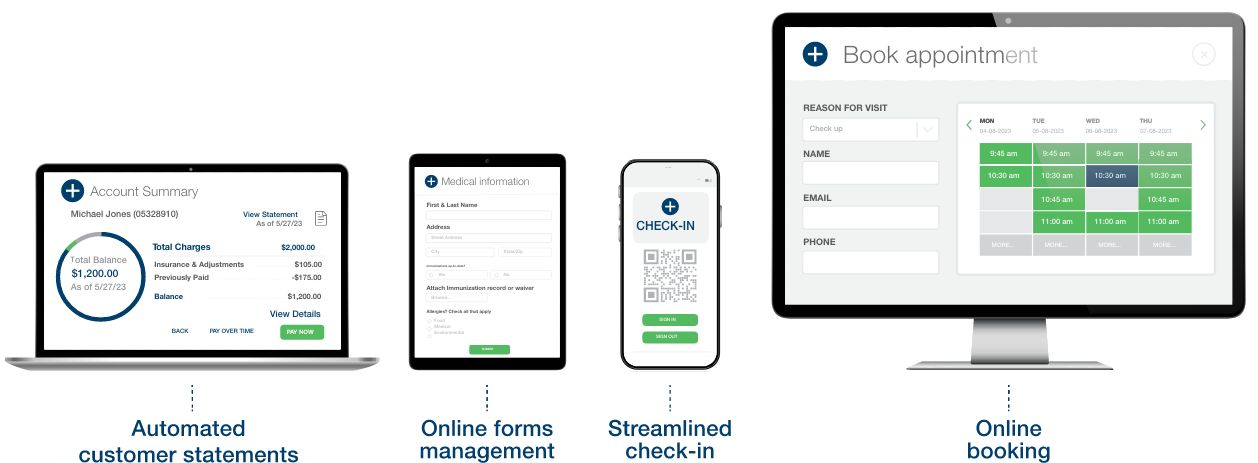

Depending on what your clients are looking for, you can add consumer-facing features à la carte to your merchants’ customer portals, branded with their banner, logo and chosen colors. These features can allow them to complete more interactions like:

- Automated customer statements

- Online forms management

- Streamlined check-in

- Online booking

… and so much more. All in one integrated system.

The online portal works on mobile or desktop, includes a personalized to-do list if the consumer has outstanding forms to complete or bills to pay, and comes with an in-portal chat function if the customer needs help. It’s also supported by our Callpop communication feature, which enables businesses to use two-way messaging throughout the customer’s journey, including sending requests, answering questions and providing reminders. These SMS or email communications can also be branded to fit the merchant’s business.

Whether your client is a tiny new auto shop or a thriving dentistry empire, letting business owners access an entire suite of customer engagement automations using a single integrated platform could help transform their approach to customer experience management – and unlock a whole new revenue cabinet for you.

Ready to get the keys to your cabinet? Reach out to our team to get started.