Editor’s Note: This blog entry was originally published on June 28, 2017, and was updated on January 19, 2021.

Recurring Payments and Card on File Models

As part of the recent pandemic-related shift away from consumers handing over physical credit cards to make a purchase, many companies have implemented additional payment methods, including card on file transactions as well as recurring payments.

Card on file refers to the practice of keeping the customer’s payment card data on file, so that when they return for subsequent purchases, the cashier can pull up the information and charge the card without the customer or cashier having to handle the physical card itself.

Recurring payments are payments that are charged in intervals (for example, at the same time each month) - usually for a subscription service such as a wine club or monthly spa plan. Recurring payments allow a business to charge the customer’s card on file on set dates, and the customer does not have to worry about remembering to make the monthly payments.

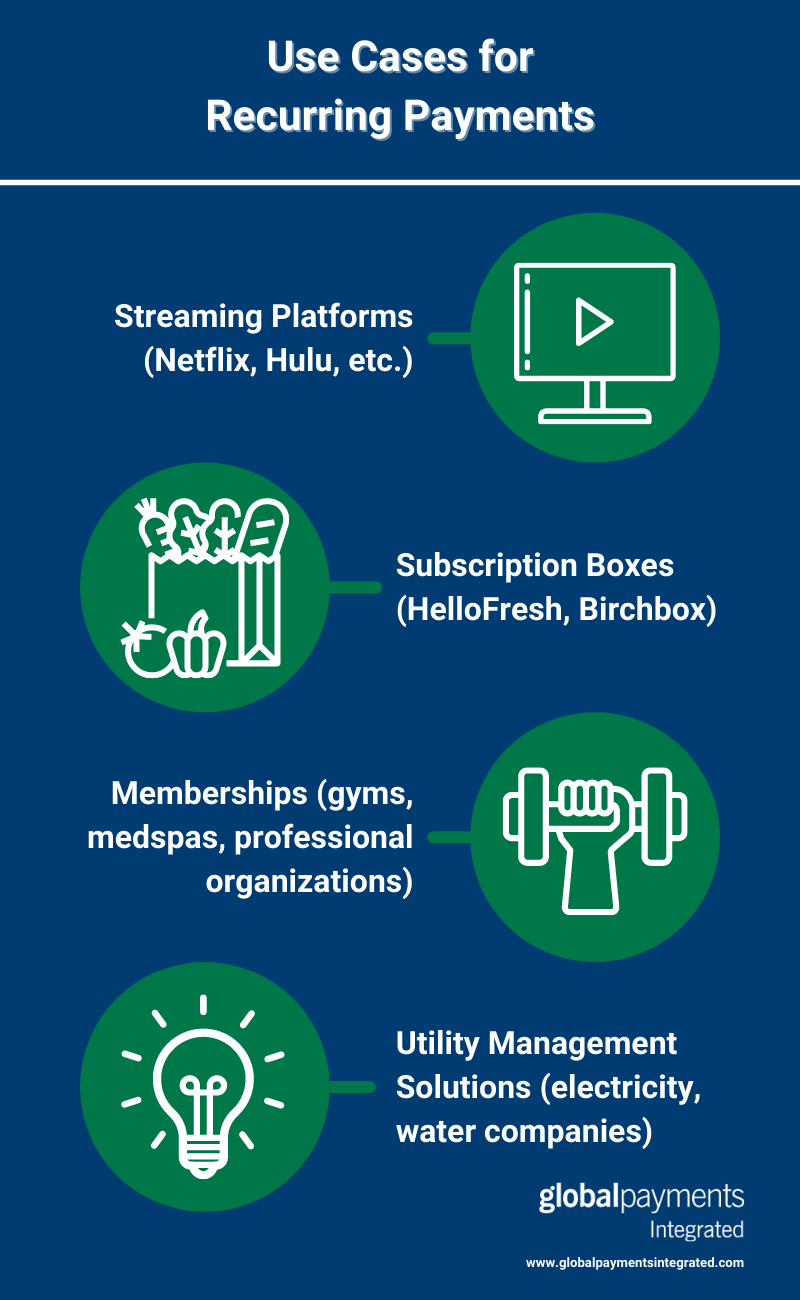

Use Cases for Recurring Payments

Recurring payments are used across many industries. Here are just a few examples:

Subscription-Based Purchases

- Streaming Platforms - The popularity of streaming entertainment has grown exponentially in recent years. Many of these streaming platforms, such as Netflix, Hulu, and Amazon Prime, operate on a subscription basis, where a payment method on file is charged monthly or yearly.

- Subscription Boxes - Between 2013 and 2018, the subscription box eCommerce market grew by more than 100% per year, and encompasses many industries. Subscription boxes, where purchasers pay a recurring monthly fee and receive a box of items each month, are available for food, makeup, household items, and more.

Memberships

Businesses such as gyms and medspas often use recurring payments to offer plans where a member can receive a certain number of services per month for a flat recurring fee. Membership dues to professional organizations also often fall under this category as well.

Utility Management Solutions

Many utility management companies who collect payments on a monthly basis, such as electricity or water companies, will give customers the option to put a card on file and allow it to be charged monthly.

Expired Cardholder Data and Card Declines

While convenient, there’s a potential downside to recurring payments and card-on-file models – declined payments resulting from lost, expired, or outdated card information. When cards decline with any regularity, businesses not only lose revenue, but are also faced with the expensive, time-consuming problem of manually reaching out to customers to get updated payment information and risking them potentially deciding to close their account at that time.

An average of 15% of all recurring payments are declined - but in some verticals, the decline rate can even be double that. Tracking down that many new expiration dates manually can quickly eat into a business’s time and revenue.

So what is a merchant to do when cards they have on file expire? While some have been known to try to “guess” a card’s new expiration date, this is generally considered unethical - and possibly even illegal in certain states. In addition, updating consumers’ credit card information without letting them know could also lead to chargebacks.

While a business could individually call each customer to get the new expiration date, this is time-consuming if the business processes a large volume of cards, and if the payments are for an optional service, these reminder calls may even lead to the customer canceling the service.

Automated Card Updating Services

Automated card updating services can alleviate these difficulties. This payment technology can be embedded into business and practice management systems. In the simplest terms, the service pings the credit card companies daily, receives the latest up-to-date card data, then automatically updates stored card information. Cards that would have been declined instead process as intended with no interruption in the payment schedule.

This results in fewer card declines - which in turn results in more revenue for the business, as well as the reclaimed time and effort that would have been spent reaching out to customers manually.

Offering customers the functionality to support a variety of transaction types through one solution is imperative in today’s market. Global Payments Integrated supports card on file and recurring payments, and also offers an automated card updating service. To find out how to include this service in your software, contact us today.