NFC, or near-field communication, refers to technology that allows enabled devices that are near each other to wirelessly share data. Near-field communication has become an important part of the technology behind mobile payments. This guide will discuss what it is, how it works, and the benefits for integrating this technology into the solutions you offer.

An Introduction to NFC

What is NFC?

NFC stands for near-field communication. This technology allows devices in close proximity to each other to easily communicate and share data. NFC has become a popular term in the payments industry in the last couple years with an increase in contactless payments via mobile wallets. NFC payments have increased in popularity because they provide a quick and simple way for consumers to pay, saving them time at checkout.

How Does NFC Work?

NFC technology evolved from radio frequency identification (RFID) technology. RFID can be used effectively at large distances, such as a pet microchip that can be scanned to identify a lost dog. NFC technology is more fine-tuned, operating at a range of about four inches or less. Chances are you have probably seen someone paying using their smartphone or smartwatch during checkout, and you may have noticed they had to wave their device near the payment terminal when paying via mobile wallet.

Data transmission via near-field communication technology requires two NFC-enabled devices: a transmitting device and a receiving device. NFC technology works in one of two ways: one-way communication or two-way communication.

- One-way communication: One-way communication requires an active NFC and a passive NFC device. An example of one-way communication is the interaction between an NFC-enabled smartphone being used for payment and a card reader.

- Two-way communication: Two-way communication requires two active NFC devices. One example of this is the communication that occurs between two NFC-enabled smartphones during a file transfer.

NFC and Mobile

Near-field communication is the technology behind mobile payments. The wireless data transfer provided by near-field communication technology enables contactless payments through mobile wallets such as Apple Pay®, Google PayTM, and Samsung Pay®.

NFC vs. Contactless

If you have heard the term "contactless payment" and then wondered what is the difference between a contactless payment and NFC payment, we are here to explain the two terms. A contactless payment is a secure way of paying that can use either NFC or RFID technology. Because NFC technology is what powers contactless payments,the terms are often used interchangeably. The term contactless tends to be used more generally and NFC tends to be used more specifically when speaking to the near-field communication technology that is actually being utilized to process a payment.

NFC vs. EMV

While NFC and EMV are both secure ways of accepting payments, NFC refers to the wireless method of communication between two devices, whereas EMV refers to the technology that was originally created to replace magnetic stripe cards (or "magstripe" cards) with chip cards for more security.

EMV technology is a security feature that protects card issuers, merchants and consumers from losses due to the use of counterfeit and stolen payment cards at the point-of-sale. EMV "smart cards" are embedded with a chip that interacts with a merchant’s point-of-sale device, ensuring the card is authentic and belongs to the user. This chip provides more security protection than magnetic stripe cards.

EMV can also be contactless, which is a method of payment that uses near-field communication technology to complete a mobile payment.

Benefits of Offering Mobile Payment & NFC Functionality

The benefits of offering mobile payment and near-field communication functionality to your clients are numerous. Below are just a few.

- Added security: If an end user's wallet is stolen, a thief could use their stolen credit cards quite easily. If the user's smartphone is stolen, if it is passcode-protected, it will be more difficult for the thief to access the user’s payment methods.

- Improves your merchants' customer service: Merchants and their customers are always looking to cut down on the time it takes to check out at the register. NFC allows your merchants to provide a faster payment method to their customers that includes improved convenience and ease of use.

- Versatility: NFC technology can be used in a wide variety of industries and services. It can be used to purchase goods, make both movie and restaurant reservations, and more.

The Future of NFC

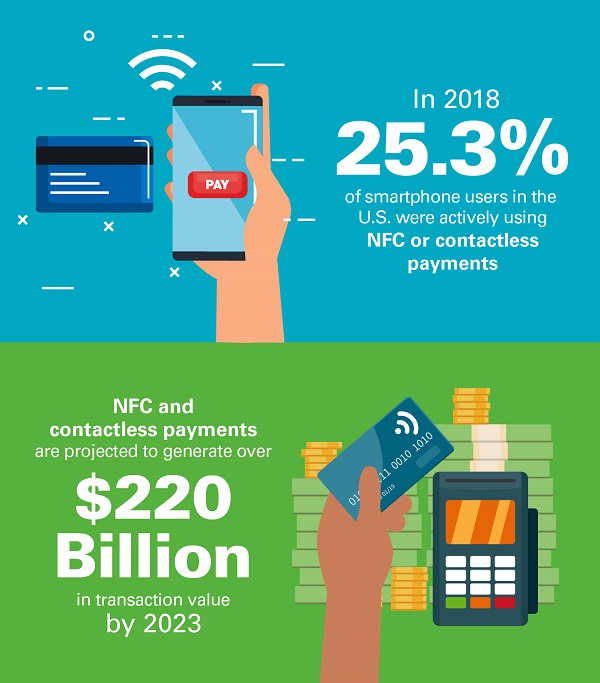

As of 2018, about 25.3 percent of smartphone users in the United States were actively using near-field communication or contactless mobile payment services. Further, according to Statista, in 2023, near-field-communications or other contactless technologies are projected to generate over 220 billion U.S. dollars in transaction value.

Mobile wallets continue to grow in popularity. In addition to Apple Pay®, Google PayTM, and Samsung Pay®, many retailers are creating their own mobile payment methods using near-field communication technology. One example is Starbucks, who now allows customers to use their mobile app to pay at the counter by waving their phone across the payment terminal.

NFC and Global Payments Integrated

With the use of NFC or contactless mobile payment services predicted to continue to grow, independent software vendors need to integrate these services into their solutions. Global Payments Integrated offers flexible mobile solutions for your business. Our Mobile SDK supports an easy integration for both web and native mobile applications while providing feature-rich payment functionality and industry-standard security. The benefits of our mobile solutions include:

- Flexibility and Security: Our feature-rich solutions support current card-based technologies such as EMV (chip cards) and mobile payments such as Apple Pay, Google Pay, and Samsung Pay while providing industry-standard security features including encryption and tokenization.

- Customizable User Interface: Integrators maintain the freedom to retain their own user interface, providing a more transparent user experience.

- Protected by EdgeShield: All mobile solutions are covered under the security of EdgeShield, our proprietary bundle of EMV®-ready security solutions, ensuring maximum PCI scope reduction for your software solution.

- Omni-Channel Support: Global Payments Integrated has a mobile solution that fits your customer needs. Our mobile integrations support card-present EMV (chip cards), card-not-present transactions and tokenization (card on file).

Conclusion

With NFC and contactless mobile payments continuing to grow as a preferred payment method, ISVs need to be able to offer this technology within their software solutions in order to stay competitive in the ever-evolving payments landscape. Global Payments Integrated supports all major digital wallet, NFC and EMV contactless solutions, allowing consumers to pay using contactless cards or the personal devices they carry with them daily. Contact us today to learn more.

Apple Pay® is a trademark of Apple, Inc. All trademarks contained herein are the sole and exclusive property of their respective owners.

Google PayTM is a trademark of Google, Inc. All trademarks contained herein are the sole and exclusive property of their respective owners. Any such use of those marks without the express written permission of their owner is prohibited.

Samsung Pay® is a registered trademark of Samsung Electronics Co., Ltd.