Editor’s Note: This blog entry was originally published on March 6, 2019, and was updated on June 19, 2020.

What is EMV Contactless?

The security features built into credit cards have evolved rapidly over recent years. The once-ubiquitous “magstripe” (magnetic stripe) gave way to EMV chip cards because EMV chips are more secure than magstripes. A chip card is a payment card containing one or more computer chips or integrated circuits for identification, data storage or special purpose processing used to validate personal identification numbers (PINs), authorize purchases, verify account balances and store personal records. Recently, EMV chip cards have further evolved into EMV contactless cards.

Think of EMV contactless (sometimes referred to as “tap-and-go”) as the perfect marriage of the security features of EMV technology combined with the ease, speed and convenience of NFC (near-field communications). NFC is the technology that allows your credit card to communicate with an NFC-enabled terminal at close range. It drives the functionality behind popular mobile payment platforms like Apple Pay®, Google PayTM, and Samsung Pay®.

Contactless payments have experienced a large increase in popularity recently. According to ABI Research, an additional 110 million contactless payment cards are expected to be issued in 2020, driving global contactless payment card issuance above the two billion mark. Further, the global value of contactless debit/credit transactions is predicted to exceed $2 trillion by 2021.

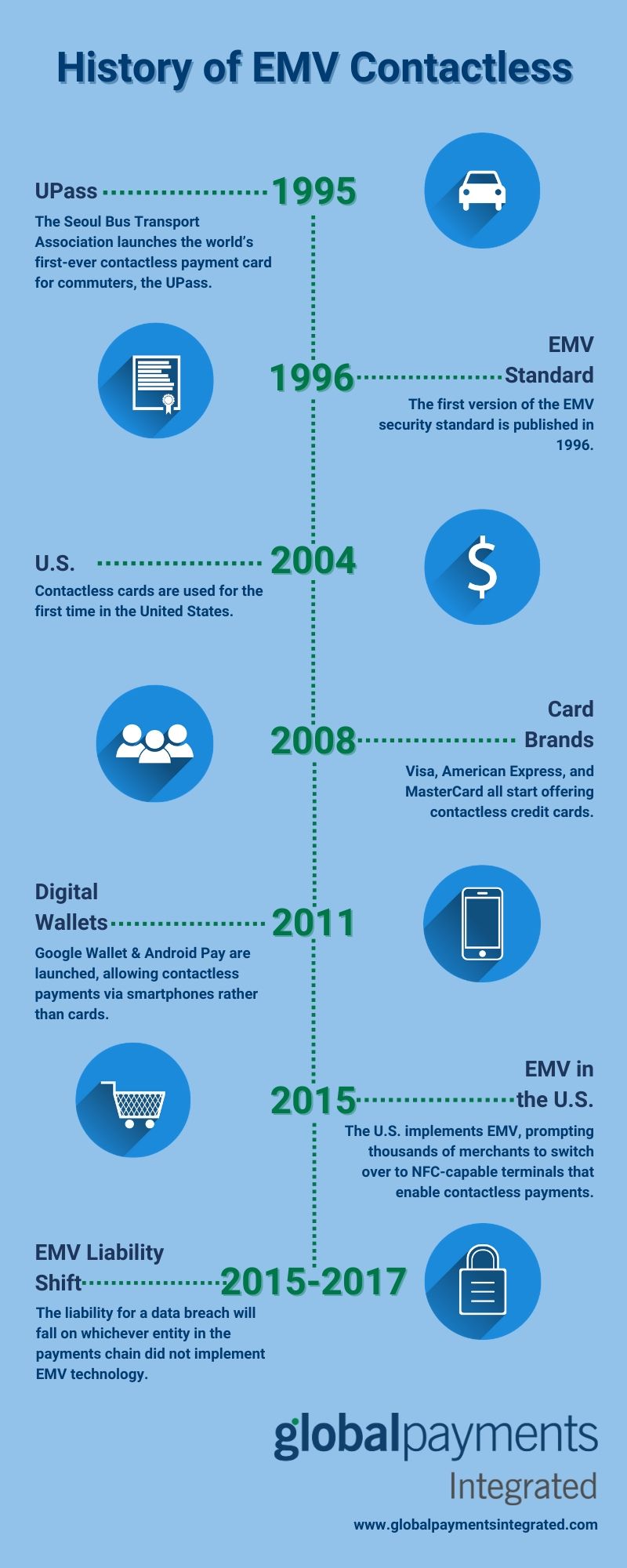

History of EMV Contactless

EMV contactless technology has continued to evolve in recent years. Here’s a brief overview of some of those milestones:

- 1995: UPass - The Seoul Bus Transport Association launches the world’s first-ever contactless payment card for commuters, the UPass.

- 1996: EMV - The first version of the EMV security standard is published in 1996.

- 2004: Contactless cards used for first time in US

- 2008: Visa, American Express, and MasterCard all start offering contactless credit cards.

- 2011: Google Wallet and Android Pay are launched, allowing contactless payments via smartphones rather than cards.

- 2015: EMV in the U.S - The U.S. implements EMV, prompting thousands of merchants to switch over to NFC-capable terminals that enable contactless payments.

- 2015-2017: EMV liability shift implemented - The liability for a data breach will fall on whichever entity in the payments chain did not implement EMV technology.

Benefits of EMV Contactless

- Security – the chip on a contactless card communicates with the POS device through short-range wireless technology by virtue of an embedded antenna. Upon tapping a contactless card, a cryptographic code is created that is unique to that specific transaction.

- Speed – The quicker speed of contactless payments is ideal in fast-moving industries who accept credit card payments, such as sporting events, convenience stores and quick-serve restaurants.

- Convenience – Much of the merchant payment processing experience for customers comes down to how quickly they can pay and get out. Credit card processors spend untold hours working on ways to help improve the customer checkout experience. Contactless results in a checkout process that almost couldn’t be easier or faster – just tap and go.

Conclusion

EMV contactless provides benefits across the board - to the merchants that accept payments as well as to the ISVs who furnish their payment processing solutions. Merchants can deliver much faster, easier cutting-edge payment options to their customers, improving the shopping experience. Software developers see EMV contactless as a staple in delivering the transaction speeds and advanced security features wanted by their merchants accepting credit card payments.

Apple Pay® is a trademark of Apple, Inc. All trademarks contained herein are the sole and exclusive property of their respective owners.

Google PayTM is a trademark of Google, Inc. All trademarks contained herein are the sole and exclusive property of their respective owners. Any such use of those marks without the express written permission of their owner is prohibited.

Samsung Pay® is a registered trademark of Samsung Electronics Co., Ltd.