With the rise of Peer-to-Peer (P2P) payment apps, it appears that the era of instant payment is here - but unfortunately, this isn’t the case. In reality, most of the payment systems in the U.S. do not have the proper infrastructure to support real-time payments right now.

Here’s what real-time payments entail, the infrastructure needed to get there, the benefits of real-time payments, and use cases to consider.

What is a Real-Time Payment System?

A real-time payment system requires a combination of speed, immediate availability, and communication. Speed means payment should happen instantly: when a payer sends payment to a payee, the payee will not only receive the funds at that moment, but those funds will also settle immediately, making it possible to spend right away if needed.

Communication is also essential. The majority of payment systems in the U.S. only have communication in one direction: from the payer to the payee. Real-time payment systems would require the ability to pass information back and forth between counterparties. At the moment, if payees wanted to know the status of their payment from someone, they would have to contact the payer directly for information—it’s not possible to see this information within the payments system. Additionally, it could also allow payees to request payments from payers securely.

The most prominent real-time payment system in the U.S. is The Clearing House’s RTP network. The Federal Reserve is currently working on its real-time payments pilot called FedNow, which will debut in 2023.

Don’t P2P payments already happen in real-time?

P2P payments solutions allow individuals to send money to other individuals through their mobile devices. Users can choose from various money transfer apps and connect a bank account or credit card to send funds.

Users get instantly notified whenever they make or receive a payment, but there is still a waiting period for the funds to be available. While certain money transfer apps can make funds instantly available, such services currently come at an additional cost to the user.

Due to the standard waiting period that P2P payments currently experience across all apps, it’s arguable that most P2P payments do not qualify as real-time payments yet.

The Benefits of Real-Time Payments

Real-time payments would be helpful for governments, financial institutions, businesses, and consumers, as they would bring much-needed flexibility around finances and efficiency within the payments journey.

Everyone can benefit from enhanced payment experiences and better cash management. Governments would be able to trace activity efficiently. Financial institutions may be able to provide better services.

Real-time payments will improve the day-to-day management of operations in any industry, as businesses will have improved cash flow. Additionally, when communications improve within the payments system, it can also lead to easier reconciliation, additional insights into business performance, and a better customer service experience.

Lastly, consumers would be less likely to worry about meeting payment deadlines for bills, as they won’t have to wait for funds to settle to make payments. All of these benefits combined would increase economic fluidity for countries across the globe.

The Fundamentals for Real-Time Funds

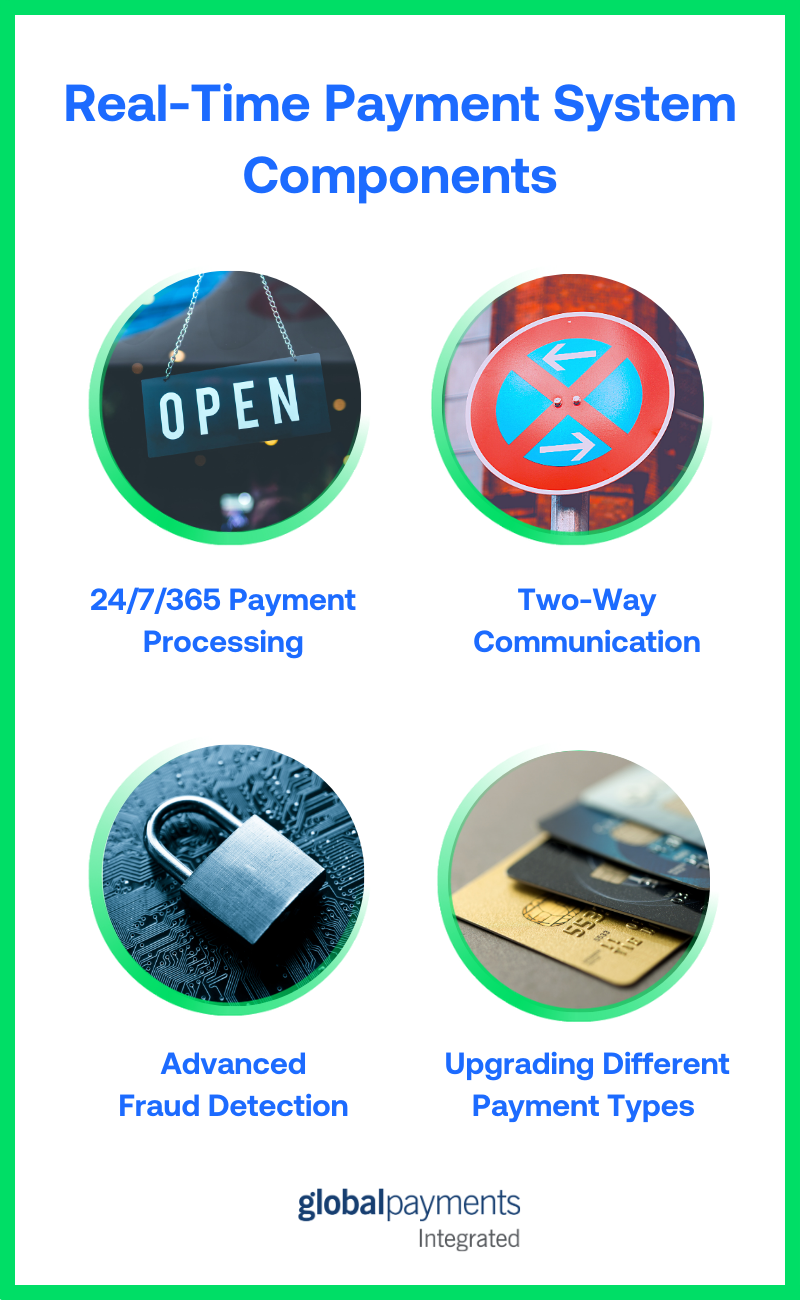

There is a need for new, digital infrastructure to make real-time payments a reality. Payment networks would be able to operate 24/7, including weekends and holidays, allowing large volumes of payments to get processed at any moment.

Platforms would also need to facilitate communication by integrating information flows, payment confirmations, and settlement notifications, allowing both parties to understand the status of their transactions.

More importantly, fraud detection methods would be a significant focus. Anti-money laundering monitoring currently runs on a “batch” environment, meaning transactions can be reviewed at the end of the day, week, or month for irregularities. Doing it this way will not be effective enough in a real-time environment, so new solutions and processes would need to be developed.

Flexibility and future-proofing is also a key consideration; in the United States, the current payments infrastructures are already decades old and were not designed for real-time notification and clearing. Different payment types such as ACH, checks, wires, and credit and debit cards would also need re-assessment to participate in real-time processing.

Real-Time Payments: Use Cases

Businesses that hire gig economy or hourly employees can use real-time payments to entice these workers with daily payroll support. Paying wages at the end of every workday gives more flexibility to employees, giving them better opportunities to handle emergencies or pay bills that don’t align with traditional paydays.

Other business use cases include industries that do disbursements, such as insurance claim payments, loan disbursements, rental deposit returns, and gambling companies that need instant disbursements to winners.

Integrating B2B real-time payments means doing away with the inefficiencies of being in an office, waiting for checks to arrive in the mail, and needing to go to the bank to make deposits. Instead, it allows companies the flexibility to make and receive B2B payments anytime, either in-office or remotely.

Getting Ready For Real-Time Payments

The demand is palpable for real-time payments, and there is a long road ahead to create the infrastructure, processes, and security features required to make it happen.

There is hope that once the FedNow pilot goes live in 2023, it can work together with The Clearing House’s Real-Time Payment network to create standards that will govern the future of faster payments in the United States.

Until then, ISVs can continue to stay on top of payments trends and future-proof their software through a partnership with Global Payments Integrated. Contact our sales team to learn how integrated electronic payments can also increase revenues for your ISV and your clients.