What are B2B Payments?

B2B payments, or business-to-business payments, are defined as payments made between two businesses for goods or services.

In a B2B payments transaction, there are typically two parties: the buyer and the supplier.

- Buyer (buying organization) - The buyer is a business buying goods and services from vendors/suppliers. The buyer is the organization making the payment.

- Supplier (vendor) - The supplier is the organization that produces and sells the goods and services and receives the payment.

B2B payments are more complex than B2C (business-to-consumer) or P2P (peer-to-peer) payments, as they involve a lot more processing steps. They are also affected by several factors that do not affect customer payments, such as:

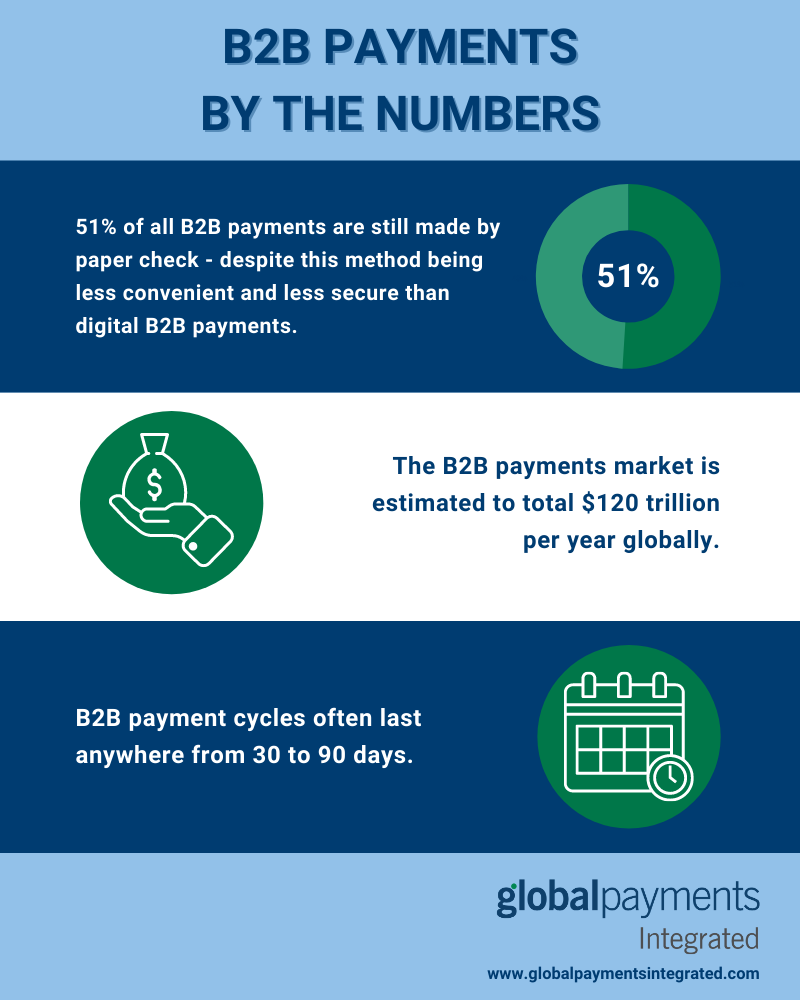

- Payment Volume - Payments between businesses are often much higher than payments between consumers. The B2B payments market is estimated to total $120 trillion per year globally, compared to the estimated P2P market at $1.84 billion.

- Payment Frequency - Businesses may have to make recurring payments, such as paying for a monthly shipment of goods from a supplier.

- Industry Needs - Different industries have different processing needs, such as healthcare providers who must abide by HIPAA laws and privacy regulations.

- Number of Teams Involved - Each B2B transaction is likely to be handled by several different teams along the way, including procurement, billing, accounts payable, accounts receivable, and possibly more.

- Processing Time - Whereas P2P payments can be instant, B2B payment cycles often last 30 days to 90 days.

B2B Payment Methods

B2B payment methods can broadly be categorized into two main types - paper checks and digital B2B payments.

- Paper Checks - A recent survey by the Association for Financial Professionals revealed that 51% of all B2B payments are still made by paper check - despite this method being less convenient and not secure.

- Digital B2B Payments - Digital B2B payments involve an online, electronic payables tool that provides businesses an efficient means to make payments to suppliers while reducing exposure to risk. Types of digital payments can include ACH, credit cards, wire transfers, electronic funds transfers (EFT), or a payment gateway.

With the recent switch of many companies from in-office to working from home, businesses began to see the benefits of digital B2B payments, as many paper checks were being mailed to businesses with no one in the office to collect and deposit them.

Benefits of B2B Payments

Benefits to Developers

- Versatility - Offering digital B2B payments within your software solution makes it more versatile, allowing your customers a quicker and easier way to handle procurement, invoicing, and invoice payments.

- Competitiveness - Digital B2B payments are becoming a popular option across industries because of their ease and security. Software developers need to offer this functionality within their solution in order to keep up with their competitors. It’s a product differentiator that can increase adoption of your software solution.

- Revenue - Offering digital B2B payments as part of a robust payment processing software solution can increase the close ratio for software developers while adding yet another stream of revenue. Software developers can continue to collect revenue off of the payments their customers process on the front end while also creating an additional new revenue stream off of the accounts payable solutions they offer on the backend.

Benefits to Your Customers

- No Change in Current Payables Process - A major benefit of offering digital B2B payments is that your customers’ process remains the same. There is no change to their operational procedures.

- Reconciliation - Digital B2B payment solutions can allow for 100% reconciliation.

- Cost Savings - Issuing and processing a paper business check can cost anywhere between $4 to $20. Digital B2B payments remove this cost.

- Automating the Process - Automating the invoicing and payment processes reduces manual processes and helps the business run more smoothly. It frees up the finance team to focus on other needed tasks.

- Reduces Errors - Manual tracking, recording, and reconciliation are error-prone. Digital B2B payments reduce these errors.

- Data Integrity and Accuracy - Errors on a paper check can cause the check to be returned, holding up the payment process. Going digital allows for more accurate data.

- More Secure - Paper checks can easily fall victim to mail theft. In recent years, companies have reported higher numbers of stolen vendor payment checks. Good digital solutions are backed up by expert payment security features.

- Improves Cash Flow - Automated B2B payments allow businesses to more easily see cash flow patterns than when they use paper checks. They can more easily control when they pay vendors - and help keep their business afloat. Poor cash flow management is the cause of small business failures 82% of the time.

- Improves Communication - Digital B2B payments can create a closed-loop communication network, therefore improving the buyer-vendor relationship.

Conclusion

Digital B2B payments offer many benefits to both software developers and their customers, including better payment security, more accuracy, and an easier and quicker process. They allow developers to improve the solutions they offer, and they help merchants improve their business processes.