ISVs looking to accept credit cards and other forms of payments within their software are probably surprised to discover how complex the payments ecosystem is. Credit card authorizations happen in seconds after a customer swipes or inserts their card, but several players behind the scenes work together to make this happen.

We’ve discussed the credit card payment process in detail in past blog posts. However, we wanted to focus on payment gateways and payment processors, as it’s common to mix these two up or misunderstand the difference between them.

What is a payment gateway?

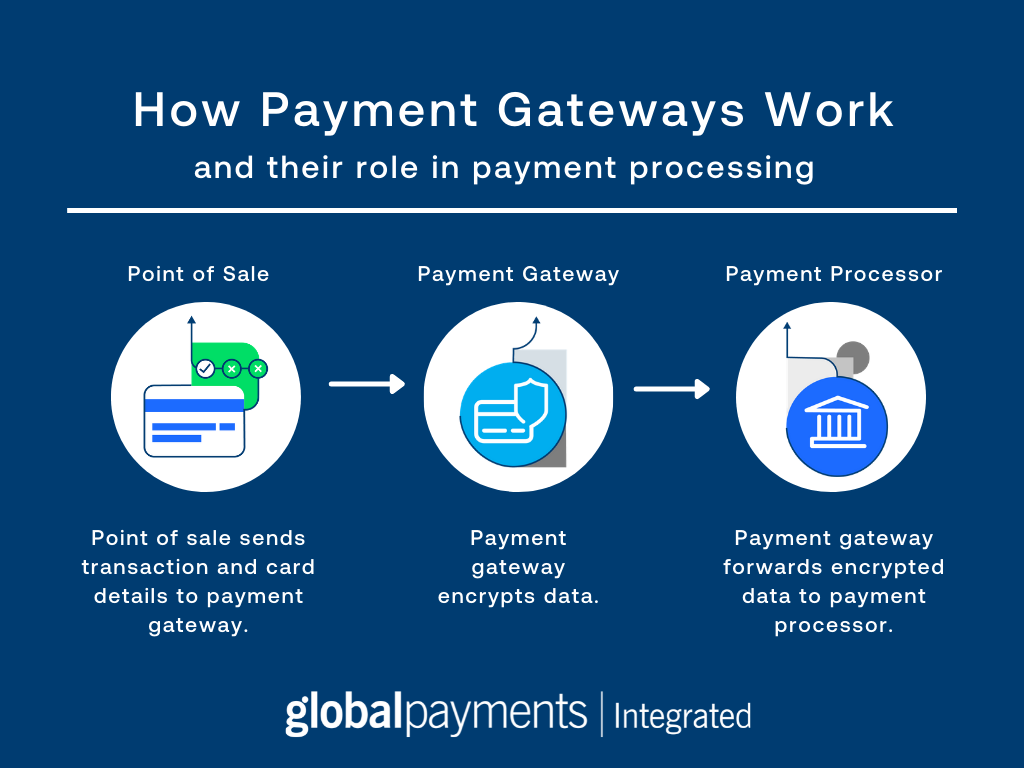

A payment gateway is a software that connects the merchant’s point of sale to the payment processor. It assists with transaction authorization by taking a customer’s credit card information and providing it to the payment processor. It is also responsible for transferring the response from the payment network (whether the payment was accepted or declined) back to the point of sale.

Uses of a payment gateway include fraud reduction and helping to prevent security breaches of personal and credit card data through encrypting sensitive credit card information during authorization. This functionality is essential for merchants who accept online payments because they cannot physically determine whether the customer is using an actual card that belongs to them during a card-not-present transaction.

Benefits of a payment gateway include ensuring merchants don’t accept cards with insufficient funds, exceed credit limits, or accept expired cards. In addition, payment gateways make sure every payment is legitimate, making it difficult for bad actors to initiate fraudulent transactions.

What is a payment processor?

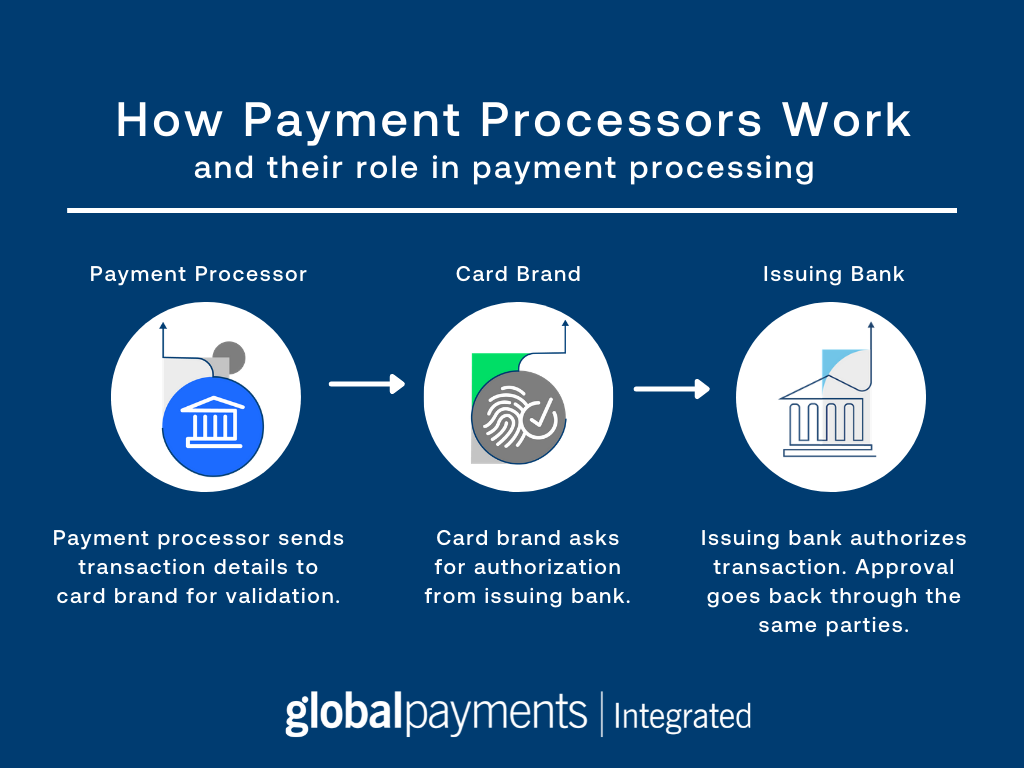

Payment processors connect merchants and financial institutions to ensure that a customer transaction is valid. They relay card information to both the merchant’s bank and the customer’s bank, confirming enough funds are available and authorizing the transaction. They also add another layer of payment security by ensuring that the card data presented is correct.

Once a transaction is authorized, the processor is then responsible for connecting the customer’s bank to the merchant’s account to transfer the funds. Additionally, processors pay the assessment fees and interchange rates charged by the issuing bank and card brand involved in the transaction.

How to choose a payment processor

It is essential that your payment processor meets high standards, as their services provide payment security that, in turn, protects your customers’ data and your business reputation. When looking, consider a processor that offers:

- A variety of payment methods, from traditional debit and credit cards to contactless payment methods

- Robust security solutions that include maintaining PCI compliance to help prevent potential data breaches

- A seamless merchant onboarding experience

Learn about the additional factors that independent software vendors should look for in a payments processor.

Payment Gateway vs. Payment Processor

Now that we know what a payment gateway and a payment processor do separately, here is an example of how they work together.

A customer initiates a payment to a business by either inserting their card into a point of sale device at a brick and mortar store or entering their credit card details on a business’ payment page for online transactions.

The credit card information and transaction details enter the payment gateway, and are encrypted and sent to the payment processor.

The payment processor transfers all the information to the card brand. Then, the card brand sends the information to the customer’s (issuing) bank.

Once the issuing bank confirms there are enough funds for the transaction, they send the approval back to the card brand, and it goes through the same parties: from the card brand to the payment processor, to the payment gateway, to the merchant, and customer.

This example shows how payment gateways and payment processors are neither interchangeable nor competitors. Instead, they are two components within the payment ecosystem that work together to help make card transactions safe and secure.

The Global Payments Integrated Difference

Global Payments Integrated is a payment processing company, but here’s the plot twist: we are also a payment gateway and acquiring bank.

By taking on multiple roles in the payment process, ISVs benefit by avoiding additional costs associated with resellers or third-party fees to acquirers. The closed-loop payments ecosystem also gives customers visibility into the entire lifecycle of each transaction.

Partnering with Global Payments Integrated puts ISVs in a win-win situation, as they have the opportunity to monetize their payments to their maximum potential while adding value to their software. Contact our sales team to see how we can improve payments within your software solution.