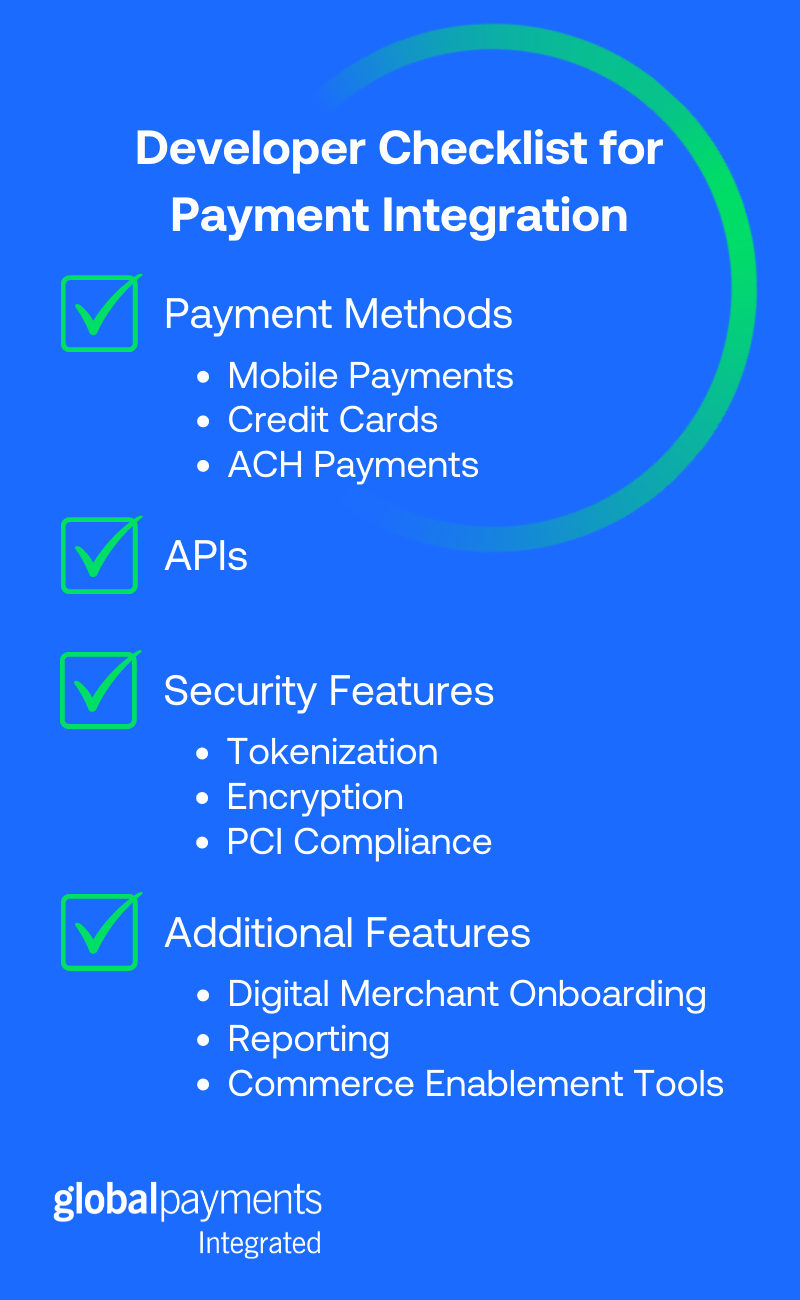

If you’re an ISV and have decided to integrate payments functionality into your software solution but don’t know where to start, we can help. Here are some best practices to consider when integrating payments into your software solution.

1) Payment Methods

ISVs should ensure their payment provider offers functionality for all the ways customers want to pay, including the following.

Mobile Payments

While the United States was initially slow to adopt mobile payments compared to other countries, the 2020 pandemic greatly accelerated the adoption of mobile payment methods such as digital wallets and contactless cards. The U.S. now ranks as the world's second-largest mobile payments market, with $465.1 billion worth of mobile transactions.

Retailers who had been hesitant to accept mobile payments changed their minds last year. A survey conducted by the National Retail Federation and Forrester in mid-2020 noted that no-touch payments had increased for 69% of surveyed retailers. The survey also found that 67% of surveyed retailers now accept some form of contactless payments, including digital wallets and contactless cards.

These statistics show how important it is for ISVs to partner with a payments provider who offers functionality for various types of mobile payments.

Credit Cards

While contactless payments have recently surged in popularity, ISV should remember that many consumers are still using debit and credit cards. In fact, the Federal Reserve Bank of Atlanta recently released findings that in 2020, 79% of consumers had at least one credit card or charge card - the highest percentage since 2008.

ISVs should make sure to offer payment functionality that can support both EMV chip cards and magnetic-stripe, or magstripe, cards.

ACH Payments

ACH, or Automated Clearing House, is an electronic funds-transfer system. Electronic check (or eCheck) payments and direct deposits are examples of ACH payments.

While it’s not talked about as often as credit cards or contactless payments, ACH is very much still a widely-used payment method. According to Nacha, the administrator of the ACH Network, there were 7 billion payments made on the ACH Network during the fourth quarter of 2020. This represents an 8.9% increase over the same period in 2019.

With such a high volume of payments being conducted via ACH, ISVs should make sure not to overlook this payment method when integrating payments functionality into their software solution.

2) APIs

An API, or Application Programming Interface, is a written instruction that enables two devices, databases, or applications to connect and share information. In the case of payments, integrating a payment gateway API with existing digital processes can connect a checkout system to a payment network.

ISVs should work with their payments partner to determine specific API integration details. Global Payments Integrated offers robust, flexible APIs that are easy and fast to integrate, regardless of your integration method. This reduces speed-to-market and eases the development cycles for developers. We also have the ability to do the development for you if that is the route you prefer to take.

3) Security Measures

When integrating payments into their software solution, ISVs must ensure they have proper security measures in place to help prevent data breaches and fraud. They should utilize a robust suite of security features that includes the following:

- Tokenization - Tokenization substitutes a non-valuable "token" in place of sensitive cardholder data.

- Encryption - Encryption is a process that encodes information (such as cardholder data) so that it is unreadable unless decrypted by someone with knowledge of the decryption key.

- PCI Compliance - PCI compliance refers to the operational and technical standards that all businesses that process, store, or transmit credit card data must follow. A good payments partner can help ensure you’re meeting these requirements.

4) Additional Features

If you partner with the right payments provider, you’ll see that payment integration isn’t limited to just payments. A good payments partner can also help you implement value-adds into your software solution, such as:

- Digital Merchant Onboarding - Your merchants want quick and easy onboarding. A digital merchant onboarding solution simplifies the onboarding process, making it less time-consuming for your customers.

- Reporting - Robust and customizable reporting solutions are a must for merchants. ISVs should offer a solution that can deliver transaction reporting data for single- and multiple-location businesses.

- Commerce Enablement Tools - Commerce enablement tools and services such as online forms and appointment booking can increase engagement, enhance the customer experience and help business grow.

For ISVs wanting to integrate payments into their software solution, this checklist is a great starting point. For more details on how integrated payments can benefit you and your customers, contact us today.