Think back to a time in your life when you felt like you had more things to do than hours in the day to get them done. Overwhelmed? Exhausted? On your third, dare we say fourth, cup of coffee? Chances are, your merchants are feeling that way on a regular basis. Being a business owner is as exhausting as it is rewarding.

You can’t make more time. But you can make the most of the time you have — and help your merchants do the same with the right tools.

An easy (but impactful) place to start is with better payment tools. After all, payments are at the heart of any enterprise, whether it’s a small business around the corner slinging coffee or a corporation shipping flowers nationwide.

Accepting and processing payments can be stressful, time-consuming and repetitive if not optimized. Taking an integrated approach may be just the cure to free your clients from administrative tasks and make room for strategic decisions.

We’ll discuss the pros and cons of integrated payments vs. non-integrated payments and what that means for your merchants and your overall business operations. Read on to learn more about these topics:

What are integrated payments anyway?

You may be asking yourself what integrated payments are and what difference they really make. At a high level, an integrated payments solution merges a company’s credit card processing functionality with other existing software capabilities.

How does that actually make a difference in the day-to-day operations of a business? Here’s an example:

Thanks to a new menu item gaining in popularity, Sara’s Pizzeria is slammed. There’s a line out the door with people waiting to be seated and another line crowding the checkout counter. Booming business isn’t usually a bad thing. But because Sara’s software doesn’t allow customers to make credit card payments online, a frazzled employee has to pull double duty by ringing up customers and taking to-go orders at the same time. It’s just not practical in the long run. With an integrated solution, Sara can give her current software an online ordering upgrade that helps her keep up with demand and take the stress off her staff.

The cost of sticking with traditional payment processing

Why do your merchants really need integrated payments? The short answer is to get paid faster and give their customers a more seamless experience — which will conveniently keep your portfolio growing. It sounds like a no-brainer, but there’s much more to it than accepting a variety of payments.

If your merchants currently have the run-of-the-mill, traditional payments setup, they may be dealing with a lot of time-consuming headaches day in and day out that you’re not aware of. Those issues can affect your bottom line as well.

How so? Take a look at some of these potential roadblocks.

Problem

It’s summer, and everyone is searching for that perfect ice cream cone. Donovan’s soft serve stand is perfectly poised near the community pool and his newly-hired cashier is standing by, ready to take orders. A lot of orders. Some paid by card, others by digital wallets, and some by cash that’s a little sticky thanks to the small boy paying for his own ice cream. At the end of the day, the cash drawer is short. By $200. Now Donovan is faced with the tiresome task of making the numbers match up by hand. It’s going to be a long night.

Solution

Better automation. Messy books should be a thing of the past. So should manual reconciliation. An integrated solution makes it easier to get the numbers right by reducing human error and keeping track of all payments. No more counting credit card payments separate from the cash drawer. As an added bonus, automated processes can make the checkout process faster so goods can pass from employee to customer with less chance of a meltdown (good for children and cones).

Problem

Lynn’s client is sitting under the hair dryer. Her next appointment has already arrived and is in a rush. By the time client #1’s hair is dry and Lynn is ready to make her way over to the front to pay, her hands will be full of foils for client #2. One of them will have to be left waiting, likely flushing Lynn’s generous tip down the drain. It’s a delicate balance, especially when one bad experience can cost her a client and earn her business a negative review online.

Solution

Bring the transaction to the client by offering flexible payment types. Integrated payments offer your merchants the chance to choose the best payment functionality suited to their specific needs. Online, mobile, contactless - the list goes on. And so do the benefits. For Lynn, the ability to take payments from the salon chair is convenient for everyone. Plus, she can get back to her other clients with less hassle and more focus. Customer experience? Five stars.

Integration is a win for you, too

Remember when we said we could help your merchants make the most of their time? Integrated payments can ease the day-to-day pain points, streamline their workflows and give them more flexibility to pivot when needed. By choosing the right payments partner, you can give your merchants an all-in-one payment platform.

Sounds wonderful for them, but what about you?

Reclaim your time

Chances are, you probably don’t have much time to focus on innovation and growth when you’re dealing with slow processes and a full schedule. It’s a harsh reality for many ISVs. The solution? Access to better tools frees you up from spending your own time or resources developing improvements.

With an integrated payments system, you get access to a myriad of benefits tailored to your business needs. This is especially important when it comes to things like equipping your merchants to better serve their customers at every touchpoint possible.

What does that look like? Take an ISV in the healthcare industry for example.

Problem

Dr. Nasher has recently lost some potential braces patients to a new orthodontist office that opened in the next town over. But why would his local patients go so far away for the same level of care they could get closer to home? He finds the new office has amazing recommendations from parents online. A quick look at the reviews tells the tale. It all comes down to convenience. They offer technology Dr. Nasher’s office can’t compete with like online form management and streamlined check-in — which means less paperwork for busy parents. And there are more visits needed than just twice-a-year cleanings when braces are involved, so a solution with fast, easy check-in is enough to sway anyone.

Solution

Keeping up with patient demand and expectations is just the start. You have to consider a solution that makes it easier for customers at every turn — from the time they open their laptop in search of the best-rated offices to when they receive their final statement. Enhanced customer experience tech can improve the overall experience for merchants and customers while helping you improve your revenue stream. If that sounds pricy and time-consuming to achieve, it’s because it can be. But with the right integrated partner, you can get an API that puts you ahead of the curve within days, saving you from costly development and testing time.

Let tech do the hard work for you

Another major component to look for when considering your payments partner is the ability to expand your tech stack with future-forward offerings. If you’re not able to keep up with the latest trends, you run the risk of falling behind. And even after spending extra time and money for the latest and greatest capabilities, there’s always something new around the corner. But the right payments partner can save you from the constant grind. With an integrated model, you get access to entire teams dedicated to assessing the market, forecasting trends, testing and developing smarter tech so you can get back to the good stuff — growing your portfolio.

The Global Payments Integrated advantage

We’ll give you a moment to digest all of that information — there’s no denying it’s a lot. But if you need a quick refresher on the difference between non-integrated and integrated solutions, here’s a summary:

Boost your bottom line

It may seem like a singular payments solution would save you processing costs, but a partner that can offer a strong go-to-market strategy and value-added products that help retain customers in your portfolio for longer can make a big impact on your cash flow.

In fact, a study by J.P. Morgan found that integrated solutions can help companies increase revenue by two to five times per customer.

An all-in-one approach provides the support and offerings you need without all the extra staff and overhead. And when your merchants have all the add-on features they need to create their perfect combination of third-party integrations, they're less likely to switch providers.

With Global Payments Integrated, you get a simple, easy-to-implement API with integration support. Plus, you can monetize your payments volume, essentially creating a forecastable revenue stream, through our revenue sharing opportunities. Each new transaction can earn you profitable residuals, but knowing how the payments ecosystem works and if your provider can effectively manage different interchange rates is crucial. It’s also important to note that you could be losing out on residuals by leaving your payment provider up to chance.

Here’s just a snapshot of some options we offer to help you grow:

Referrals

Send pre-qualified leads directly to teams designed to sell for and support your business

Buy Rates

Enjoy flexibility with residuals set according to your plan when selling and boarding new clients

Bonuses

Receive marketing support for eligible programs, including promotions and offers for your customers

Say goodbye to data security stress

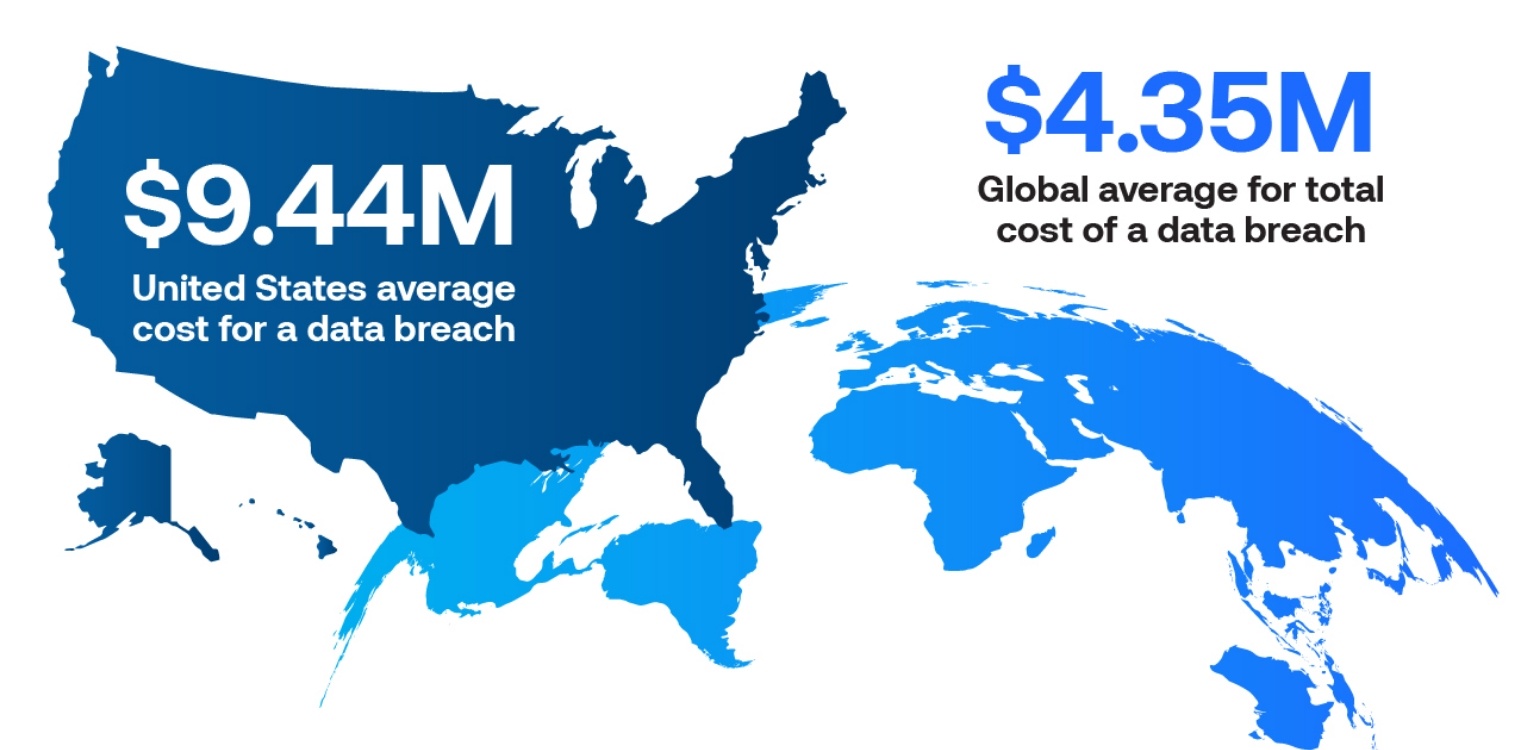

IBM reports data breaches in the United States cost more than double the global average.

With our integrated system, you get advanced security features designed with PCI compliance support and breach protection in mind. A good payment processor will offer effective tools that protect your business’ data, your merchant’s data and customer credit card information. And there’s so much more. Look for these capabilities:

EMV® processing

Protects against counterfeit and stolen cards at point-of-sale thanks to an embedded chip

End-to-end encryption

Designed to render cardholder data and payment information unreadable, encrypted at the device

Tokenization

Replaces cardholder payment data with digital tokens, securely storing sensitive data

Protect your cashflow

Speaking of secure payments…It’s equally important that your merchants have the support needed from day to day to make sure they don’t miss a sale.

Take this example into consideration:

Problem

Jordan is two years into running his successful winery that relies heavily on membership orders. Recently he’s noticed some memberships have lapsed and recurring orders aren’t going through anymore. After doing some digging, he realizes some of the cardholder information is no longer accurate. According to Forbes, credit cards tend to expire every three to five years. That means this type of thing can happen at any time, causing undue stress and potential profit loss when least expected.

Solution

Integrated payment solutions allow Jordan to rely on securely stored card-on-file data that automatically updates lost, stolen or expired cards. Plus, recurring payments are a snap thanks to a feature that can notify members and customers when their card on file is closed or canceled. No more missed sales.

Going the extra mile

Different integrated payments providers offer a variety of payment services. How do you know what’s best for your business needs? It’s true that there’s a lot of overlap from provider to provider. So it may come down to something Global Payments Integrated does really well — we offer dedicated support for merchants and partners.

You’ve probably spent quite a bit of time half-heartedly listening to on-hold music just to be redirected to a set of pre-recorded prompts. Not with us. We know it can make a world of difference when you’re facing a problem and are able to speak to an actual person.

And we mean business. There are dedicated phone lines available 24/7 for partners, developers and merchants — with real support specialists ready to take your call.

We’ll also meet you wherever you are by offering support that targets your specific needs, including:

- Tailored marketing content, digital campaigns and merchant communications

- Trade show and user conference support

- A certified inside, outside or enterprise sales team

- Teams that specialize in UI/UX coaching and design

Where do you go from here?

If you’re still not sure integrated payments are for you, that’s understandable. Picking a provider is a big commitment, and ensuring you’ve got the right one takes the utmost care. We’d love to connect and answer any lingering questions. To get in touch with one of our expert representatives, contact us today.